The TIGIE structure in Mexico

The TIGIE (Tarifa de la Ley de los Impuestos Generales de Importación y de Exportación) structure in Mexico is used to capture customs registrations.

In other words, the TIGIE is the tariff system used in Mexico to classify and regulate imports and exports.

Mexico exported products for a customs value of 593,012 million dollars in 2023, an amount 2.6% higher than in 2022, according to Inegi statistics.

Conversely, this nation imported goods for 598,475 million dollars last year, a year-on-year decrease of 1 percent.

Customs records represent the main source for generating Mexico’s Merchandise Trade Balance (BCMM).

Also, their use during information processing contributes to a deeper analysis of merchandise, trends and economic structures at any level of disaggregation.

The TIGIE classifies goods into various categories and assigns specific tariff rates to each category and is based on the International Harmonized System of Tariff Codes.

In turn, the Harmonized System is recognized worldwide for classifying traded products.

TIGIE Structure

The Harmonized System helps determine the duties and taxes applicable to different goods entering or leaving the country.

It also serves as a basis for trade statistics and regulatory purposes.

The TIGIE is updated periodically to reflect changes in international trade practices and to align with global standards.

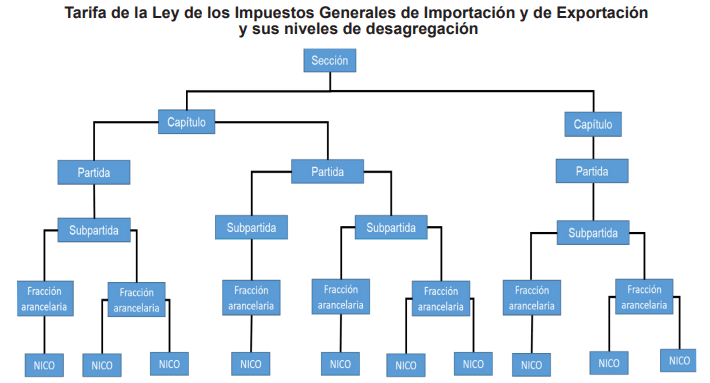

Regarding the dissemination of information, its use enables the publication of the amount of exports and imports at the Chapter, Heading, Subheading and Tariff Item level.

From 2021 onwards, Chapter, Heading, Subheading, Tariff Item and Tariff Item and Trade Identification Number (TIN), it also allows the fulfillment of requirements to different national and international users at different levels of classification.

According to INEGI, international comparability is at the Subheading level (six digits).

The TIGIE additionally considers chapter 98 in which special operations are classified, while for statistical purposes INEGI incorporates chapter 99 where those records that are not consistent with the current tariff are integrated.

Imports

The country classifier used is Appendix 4 of Annex 22 of the General Rules for Foreign Trade, which is based on the ISO-ALPHA 3 international standard.

In the case of imports, reference is made to the country of origin, while for exports, the country of last known destination is used.