Mexico and Canada increased their exports of products to the US market in April, 20.9 and 38.4%, respectively, the Department of Commerce reported on Tuesday.

With this, Mexican sales reached 38,874 million dollars and Canadian sales were 38,075 million.

In general, the growth of foreign sales measured in value was impacted by the significant inflationary pressures facing the world economy.

The United Nations (UN) forecasts global inflation to rise to 6.7% in 2022, double the average of 2.9% during 2010-2020.

In particular, headline inflation in the United States has reached the highest level in four decades. In developing regions, inflation is rising in Western Asia and Latin America and the Caribbean.

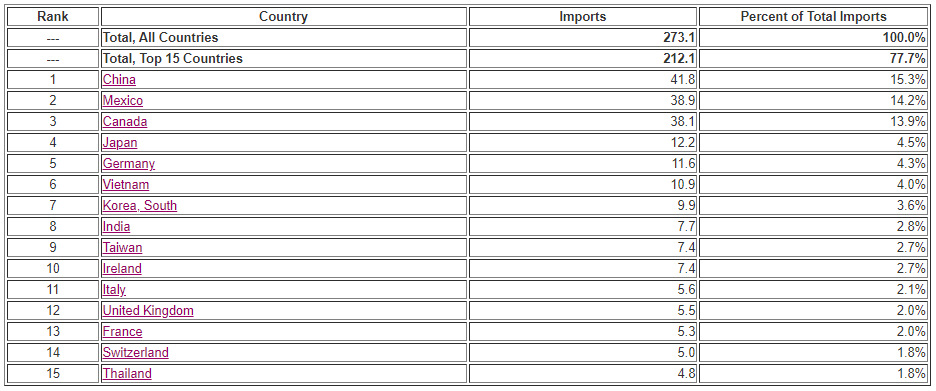

US imports april 2022

Trade in goods on a Census Basis, in billions of dollars, unrevised

Soaring food and energy prices are spilling over into the rest of the economy, as reflected in the significant rise in core inflation in many economies.

For its part, exports of products from China to the United States totaled 41,772 million dollars in April, an increase of 11.7% year-on-year.

Exports

Major central banks in developed economies will need to calibrate their interest rate increases to contain inflationary pressures while minimizing their indirect effects on borrowing costs and debt sustainability in developing countries.

Amid strong consumer spending, the US Federal Reserve raised its funds rate by a total of 75 basis points in two consecutive rate hikes in March and May 2022 and signaled it would embark on a slower pace. aggressive rate hikes.

The Federal Reserve will need to ensure that inflation expectations remain anchored, while avoiding a hard landing for the economy.

Meanwhile, the European Central Bank, which has so far kept its main policy rate unchanged, had signaled a more gradual approach to monetary tightening.

In response to escalating prices, many countries are looking to expand domestic energy supplies. In the short term, these efforts will likely result in more fossil fuel production.

In the United States, the world’s largest producer of oil and natural gas, higher prices and growing concerns about energy security have led to an increase in drilling activities.

In mid-April, the US rig count, which measures the number of active oil wells, was 58% higher than a year ago.

Meanwhile, the US Government has announced the release of 1 million barrels of crude oil every day for the next six months from its Strategic Petroleum Reserve to reduce energy prices.

![]()