The structure of Japan‘s applied MFN tariffs remains complex, according to a World Trade Organization (WTO) report.

In a total of 272 tariff rates, there are 136 different ad valorem rates, 75 different specific rates, 29 different alternative rates, and 24 different compound rates, in addition to other different duty classes (4 differential duties and 4 movable duties).

In the WTO, each nation sets caps on its tariffs and is obliged to give everyone MFN status, an expression that seems to suggest that this is some kind of special treatment for a given country, but in reality means charging their respective tariffs to all members equally.

Japan’s customs tariff consisted of 9,467 lines in FY2022, excluding those subject to in-quota applied rates (up from 9,181 in FY 2019), at the nine-digit level of the HS 2022 nomenclature.

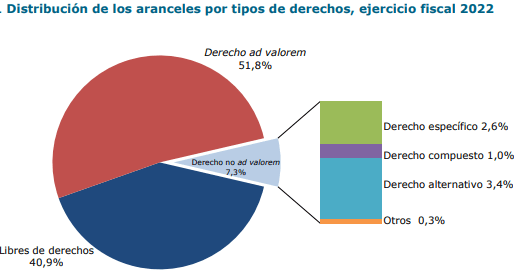

Ad valorem duties are applied to 92.7% of tariff lines (including duty-free lines, which account for 40.9% of the total).

In addition, Japanese customs applies non-ad valorem rates to the remaining 7.3% (i.e., 689 lines), corresponding mainly to fats and oils, footwear, food industry products, mineral products, live animals and animal products, and textiles and clothing.

During fiscal 2022, the overall arithmetic average MFN tariff rates applied by Japan is 6.3% (the same as in fiscal 2019).

MFN Tariffs

In particular, the arithmetic average applied MFN tariff rates for agricultural products (WTO definition) is 18.0% (17.9% in FY 2019), compared to 3.4% for non-agricultural products (3.5% in FY 2019).

Overall tariff escalation in fiscal 2022 is higher for first-stage processing and lower for semi-finished products.

However, this trend is not always reflected at the product level; for example, in the case of food, beverages and tobacco, it is the semi-finished products that attract the highest rates.