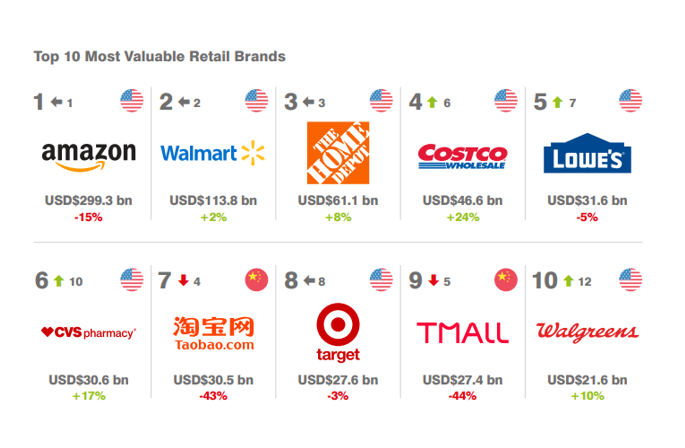

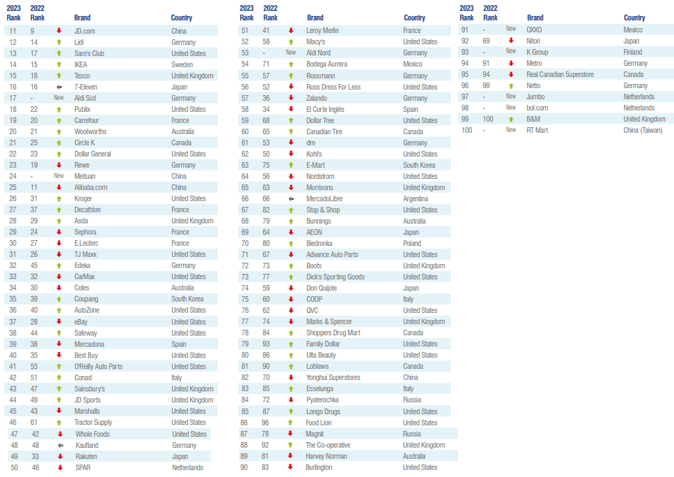

The consulting firm Brand Finance released the 100 most valuable retail brands in its 2023 ranking, which was led by Amazon.

Then came, in descending order, Walmart, Home Depot, Costco, Lowe’s, CVS, Taobao, Target, Tmall and Walgreens.

Consumer expectations may change in response to complaints, improved reporting requirements, education and media coverage.

If Amazon does not keep pace through a preemptive approach to improving its sustainability performance, and does not clearly and honestly communicate its progress, those billions of dollars of value could be in jeopardy, according to Brand Finance.

This consultancy reviews what brands already pay in royalty agreements. Added to that is an analysis of the impact of brands on industry profitability versus generic brands. The result is a range of possible royalties that could be applied in the industry to brands (e.g., between 0 and 2% of revenue).

Brand Finance then adjusts the higher or lower rate for brands by analyzing brand strength. It analyzes brand strength by looking at three key pillars: «Inputs», which are the activities that support the future strength of the brand; «Equity», which are the actual current insights from its market research and other data partners; «Output», which are the performance measures related to the brand, such as market share.

Retail brands

Each brand is assigned a Brand Strength Index (BFI) score of 100, which is used to calculate brand equity.

Based on the score, each brand is assigned a corresponding Brand Rating of up to AAA+ in a format similar to a credit rating.

The BSI score is applied to the royalty bracket to derive a royalty rate. For example, if the royalty bracket in an industry is 0-5% and a brand has a BSI score of 80 out of 100, the appropriate royalty rate for the use of this brand in the industry in question will be 4 percent.

In addition, Brand Finance determines brand-specific revenues as a proportion of parent company revenues attributable to the brand in question and forecasts those revenues by analyzing historical revenues, stock analysts’ forecasts and economic growth rates.

It then applies the royalty rate to the forecast revenue to arrive at the brand’s revenue and applies the relevant valuation assumptions to arrive at a discounted present value, after tax, that equals the value of the brand.