The Chinese government wants to sign more FTAs with Latin American countries

The Chinese government has announced that it is seeking to sign more FTAs with Latin American countries and expand trade and investment cooperation in the

The Chinese government has announced that it is seeking to sign more FTAs with Latin American countries and expand trade and investment cooperation in the

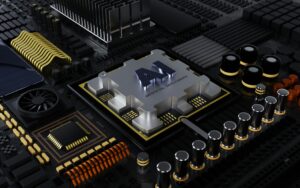

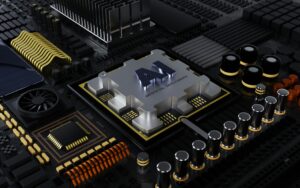

India is positioning itself as a strategic market for companies seeking business opportunities in artificial intelligence. Its digital expansion, STEM talent, and accelerated adoption of

The objectives of the USMCA are being met, according to the Progressive Policy Institute (PPI) on the first day of hearings at the Office of

The Toy Association in the United States has called for strengthening manufacturing in the United States-Mexico-Canada Agreement (USMCA). From its perspective, the benefits of the

Manufacturing supply chains contribute to North American national security, according to the American Chamber of Commerce in Canada (AmCham Canada). According to its analysis, the

Global manufacturing services and technology solutions company Jabil is advancing in the production of humanoids in Mexico. “Jabil is starting up a plant in Chihuahua.

Intermediate goods imported into Mexico hit a record high in the first half of 2025, at US$239.603 billion, according to data from the Bank of

Mexican manufacturing exports grew five years in a row at year-on-year rates, considering the first half of 2021 to 2025, Inegi reported this Monday. From

Industrial activity in the United States will boost Mexican manufacturing in 2026, according to the Ministry of Finance. Its projection: in the area of foreign

The Mexican Business Council for Foreign Trade, Investment and Technology (Comce) highlighted that tariff effects include U.S. exports to Mexico According to its outlook, the

The Chinese government has announced that it is seeking to sign more FTAs with Latin American countries and expand trade and investment cooperation in the

India is positioning itself as a strategic market for companies seeking business opportunities in artificial intelligence. Its digital expansion, STEM talent, and accelerated adoption of

The objectives of the USMCA are being met, according to the Progressive Policy Institute (PPI) on the first day of hearings at the Office of

The Toy Association in the United States has called for strengthening manufacturing in the United States-Mexico-Canada Agreement (USMCA). From its perspective, the benefits of the

Manufacturing supply chains contribute to North American national security, according to the American Chamber of Commerce in Canada (AmCham Canada). According to its analysis, the

Global manufacturing services and technology solutions company Jabil is advancing in the production of humanoids in Mexico. “Jabil is starting up a plant in Chihuahua.

Intermediate goods imported into Mexico hit a record high in the first half of 2025, at US$239.603 billion, according to data from the Bank of

Mexican manufacturing exports grew five years in a row at year-on-year rates, considering the first half of 2021 to 2025, Inegi reported this Monday. From

Industrial activity in the United States will boost Mexican manufacturing in 2026, according to the Ministry of Finance. Its projection: in the area of foreign

The Mexican Business Council for Foreign Trade, Investment and Technology (Comce) highlighted that tariff effects include U.S. exports to Mexico According to its outlook, the