Industrial Real Estate: El Bajio

Industrial real estate has remained in strong demand in El Bajío, a region in north-central-western Mexico. There, inventory registered 13.4 million square meters, representing an

Industrial real estate has remained in strong demand in El Bajío, a region in north-central-western Mexico. There, inventory registered 13.4 million square meters, representing an

According to preliminary figures from the Mexican government, 30.3% of the maquiladora industry’s value added in 2022 corresponded to the production of transportation equipment. The

Mexico‘s economy posted 3.1% y-o-y growth in 2022, driven by private consumption and manufacturing. Going forward, BBVA forecasts that private consumption will continue to show

The Mexican Ministry of Economy informed that it has opened permanent channels of dialogue with its counterparts in Colombia and Chile to seek a consensual

Mexico and Canada won a dispute settlement panel against the United States regarding automotive rules of origin under the USMCA. On August 20, 2021, the

The Mexico-U.S.-Canada Agreement (USMCA), in addition to product-specific rules, incorporates a Labor Value Content (LVC) requirement for automotive goods. Under this requirement, passenger cars and

Mexico, among a few other countries, did not experience real wage growth associated with increased use of robots (automation), highlights a report released by the

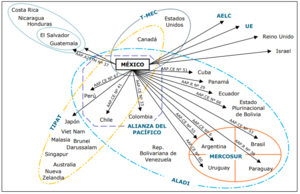

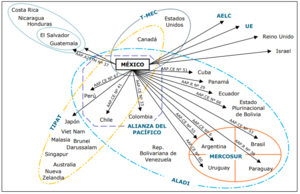

Mexico has signed numerous trade agreements, from sectoral to other deep trade integration agreements, according to information from the World Trade Organization (WTO). Among others,

Mexico‘s Ministry of Economy included electromobility as part of five strategic sectors it selected in its new industrial policy. The other four sectors are: agri-food;

Among its sectoral programs, the Banco Nacional de Comercio Exterior (Bancomext) supports companies exporting to the Mexico-United States-Canada Trade Agreement (USMCA) region. In particular, Bancomext’s

Industrial real estate has remained in strong demand in El Bajío, a region in north-central-western Mexico. There, inventory registered 13.4 million square meters, representing an

According to preliminary figures from the Mexican government, 30.3% of the maquiladora industry’s value added in 2022 corresponded to the production of transportation equipment. The

Mexico‘s economy posted 3.1% y-o-y growth in 2022, driven by private consumption and manufacturing. Going forward, BBVA forecasts that private consumption will continue to show

The Mexican Ministry of Economy informed that it has opened permanent channels of dialogue with its counterparts in Colombia and Chile to seek a consensual

Mexico and Canada won a dispute settlement panel against the United States regarding automotive rules of origin under the USMCA. On August 20, 2021, the

The Mexico-U.S.-Canada Agreement (USMCA), in addition to product-specific rules, incorporates a Labor Value Content (LVC) requirement for automotive goods. Under this requirement, passenger cars and

Mexico, among a few other countries, did not experience real wage growth associated with increased use of robots (automation), highlights a report released by the

Mexico has signed numerous trade agreements, from sectoral to other deep trade integration agreements, according to information from the World Trade Organization (WTO). Among others,

Mexico‘s Ministry of Economy included electromobility as part of five strategic sectors it selected in its new industrial policy. The other four sectors are: agri-food;

Among its sectoral programs, the Banco Nacional de Comercio Exterior (Bancomext) supports companies exporting to the Mexico-United States-Canada Trade Agreement (USMCA) region. In particular, Bancomext’s