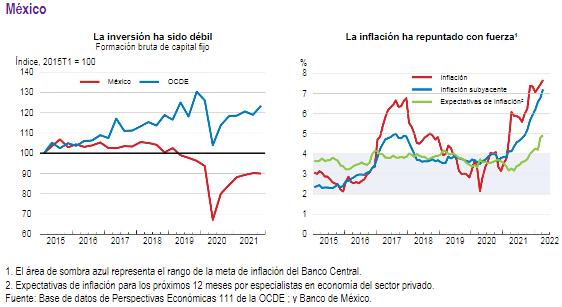

Investment in Mexico has remained weak, according to a report by the Organization for Economic Cooperation and Development (OECD).

In general, the expansion projection for the Mexican economy is 1.9% in 2022 and 2.1% in 2023.

Consumption will be favored by a gradual improvement in the labor market, as well as by an increase in the proportion of the vaccinated population.

At the same time, exports will continue to benefit from deep integration into international value chains and a gradual recovery in tourism.

While planned public infrastructure projects will boost investment, inflation will stand at 6.9% in 2022, falling back to 4.4% in 2023, according to OECD projections.

The Organization believes that a greater boost to public investment and social spending would accentuate the recovery.

From its point of view, the measures to respond to the increase in energy prices must be temporary and well focused on SMEs and the most affected households.

The OECD believes that monetary policy should continue to tighten in order to keep inflation expectations anchored.

Also, providing investors, both domestic and foreign, security over existing contracts and regulatory stability would help drive investment.

OECD

Improving access to and quality of child care services would encourage women‘s labor participation and reduce educational inequalities, considers the OECD.

The recovery has resumed unevenly and inflation has picked up strongly.

Following weakness in the second half of 2021, Mexico’s real GDP grew 1% (seasonally adjusted quarterly rate) in the first quarter of 2022.

While auto production remains constrained by supply chain issues and consumption of services and private investment lags behind, consumption of non-durable goods is already above pre-pandemic levels.

Unemployment and underemployment have declined but remain above pre-pandemic levels.

Global inflation, supply chain disruptions and external factors continue to exert significant pressure on both headline and core inflation.

![]()