Mexico achieved a nearshoring FDI record despite the tariffs imposed by U.S. President Donald Trump.

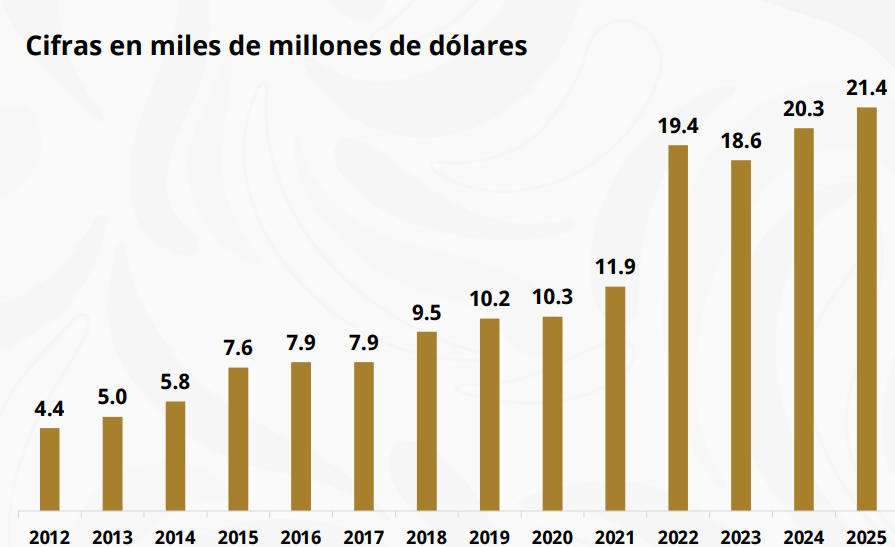

From January to March 2025, Mexico captured FDI of 21.4 billion dollars, the highest amount for an equal period.

Near-shoring (relocation) has regained relevance after a period of uncertainty due to Trump’s tariffs.

While this period of trade, stock market and logistics turbulence is still ongoing, the U.S. tariff strategy has taken shape with some degree of clarity.

While the primary target of the new tariffs is China, the Trump Administration has granted differential treatment in favor of both Mexico and Canada.

These treatments put the two U.S. neighbors in a comparative advantageous position. But they have eroded and violated the Mexico-U.S.-Canada Treaty (USMCA).

FDI nearshoring

FDI inflows to Mexico in the first quarter of 2025, imply a year-on-year increase of 5.4%, considering preliminary figures.

The following is the trend of FDI inflows to Mexico in the first quarter of each year, in millions of dollars, according to data from the Ministry of Economy:

- 2021: 11,900.

- 2022: 19,400.

- 2023: 18,600.

- 2024: 20,300.

- 2025: 21,400.

Tariffs

Trump has authorized new tariffs on dozens of countries (reciprocal tariffs) in the range of 10% to 50%. He, too, put into effect universal tariffs of 25% on U.S. imports of autos, steel and aluminum. And he enacted a 25% tariff on imports from Mexico and Canada that do not comply with the USMCA.

Meanwhile, the governments of the United States and China announced a key agreement. Both countries decided to reduce tariffs and pause their trade war. In addition, they established a 90-day negotiation period.

As a result, the United States will lower tariffs on Chinese products. They will go from 145% to 30%. For its part, China will also reduce its tariffs. These will go from 125% to 10%. But other previous tariffs on China will remain in place.

Mexico and Canada will have certain discounts on the tariffs charged by U.S. Customs on auto imports, depending on the level of U.S. content value in those vehicles.