In 2021, Chile recorded estimated copper reserves of 200 million metric tons, representing 23% of world reserves, and produced 5.6 billion metric tons of copper.

Large quantities of iodine, coal, gold, silver, nitrate, iron ore and molybdenum are also found in Chile.

Therefore, the mining sector contributes significantly to Chile’s export sector and GDP. While non-manufactured mining exports are recorded in the mining sector, the mining production process is included in the manufacturing sector.

In general, Chile has large reserves of metallic and non-metallic mineral resources and is the world’s largest copper producer.

In the 1990s, Chile’s mining sector grew driven by increased investment, including the opening of new large mines.

By 2020 and 2021, this sector accounted for 11.8% and 14.6% of GDP, respectively.

Mining products in 2020 and 2021 accounted for approximately 57.3% and 61.9%, respectively, of Chile’s total exports, which totaled approximately US$42.5 billion in 2020 and US$58.6 billion in 2021.

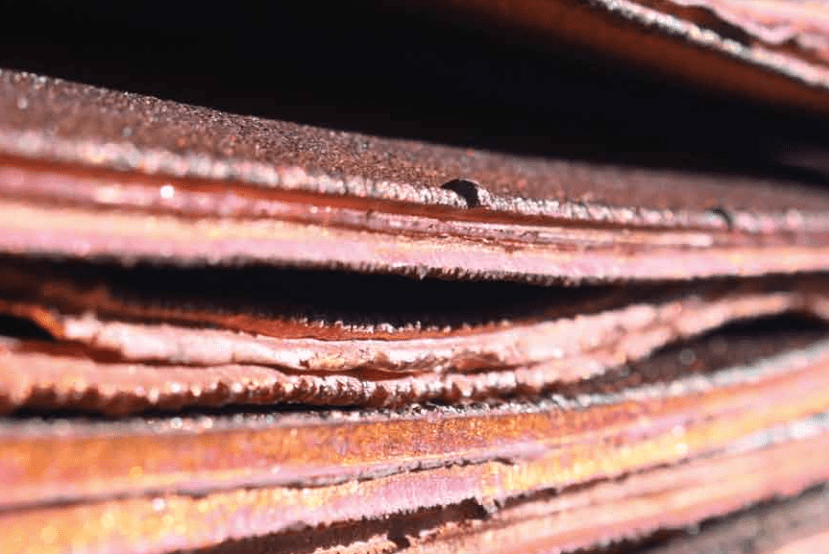

Copper reserves

Copper is mined by a combination of state-owned and private companies. The state-owned copper company, Codelco, is the world’s largest copper producer, as well as Chile’s largest company.

While Codelco contributed $5.8 billion to government revenues in 2021, private mining contributed $3.8 billion in 2021.

Under Chilean law, Codelco’s net profits are subject to a 40.0% excise tax in addition to the corporate income tax generally applicable to domestic companies and paid by its private sector competitors.

In addition, as a fully state-owned company, Codelco contributes all of its net income to the central government budget through profit transfers.

In 2017, 2018, 2019, 2020 and 2021, government revenues from copper amounted to US$1.4 billion, US$1.7 billion, US$3.7 billion, US$1.3 billion and US$5.8 billion, respectively.

Although the mining sector remains the recipient of most foreign investment in Chile, a trend towards diversification has made the electricity and services sectors increasingly attractive to foreign investors, while mining investment has declined in relative terms.

Foreign investment in the mining sector in 2016, 2017, 2018, 2019 and 2020, the latest available data, amounted to US$3.1 billion, US$2.8 billion, US$100 million, US$1.6 billion and US$2.1 billion, respectively.