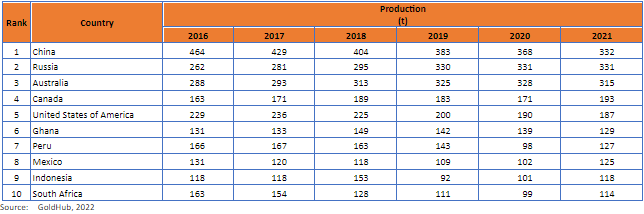

China, Russia and Australia ranked as the largest gold producing companies in the world during 2021, according to GoldHub.

Each of these nations produced nearly equal amounts: China (332 tonnes), Russia (331 tonnes) and Australia (315 tonnes).

During 2021, the gold price ranged from $1,677 per ounce to a high of $1,959 per ounce.

Likewise, the average market price for the year of $1,799 per ounce represented an all-time annual high and a 2% increase compared to 2020.

Other nations highlighted in gold production in 2021 are: Canada (193 tons), the United States (187 tons), Ghana (129 tons), Peru (127 tons), Mexico (125 tons), Indonesia (118 tons) and South Africa (114 tons).

As for the ranking by companies, Newmont is the leader, followed by Barrick Gold, Agnico Eagle, Gold Fields, Anglogold Ashanti, Newcrest Mining, Kinross Gold, Northern Star Resources, Endeavour Mining and Harmony Gold.

In 2021, the gold price showed significant strength. This was primarily driven by the financial effects of Covid-19. Global economic uncertainty further contributed to the trend. Moreover, the anticipated long-term impact of fiscal and monetary stimulus supported the price.

However, certain factors limited its growth. The strengthening U.S. dollar played a key role. Additionally, there was a notable decline in global gold exchange-traded fund holdings, which tempered the price.

Gold producing companies

Gold prices recently exceeded $2,000 per ounce, marking the first time since August 2020. This increase is mainly attributed to inflation concerns and rising geopolitical risks. Notably, Russia’s invasion of Ukraine in February 2022 has been a key factor.

Barrick Gold, a major player in the global gold market, ensures its gold meets market delivery standards. To achieve this, it refines the metal through various facilities worldwide. Once refined, the gold is sold to bullion dealers or other refiners at current market prices. Furthermore, certain operations by Barrick produce gold concentrate, which is then sold to smelters.

The company relies on a broad network of smelters and refiners. Barrick considers that losing any specific smelter or refiner would not cause significant disruption to its operations. This is due to the availability of alternative services within the market.

On the other hand, product manufacturing and bullion investment are two major sources of gold demand.

The introduction of more accessible and liquid gold investment vehicles has further facilitated gold investment.

Within the fabrication category, there are a wide variety of end uses, the largest of which is jewelry manufacturing.

Other fabrication purposes include official coins, electronics, various industrial and decorative uses, dentistry, medals and medallions.