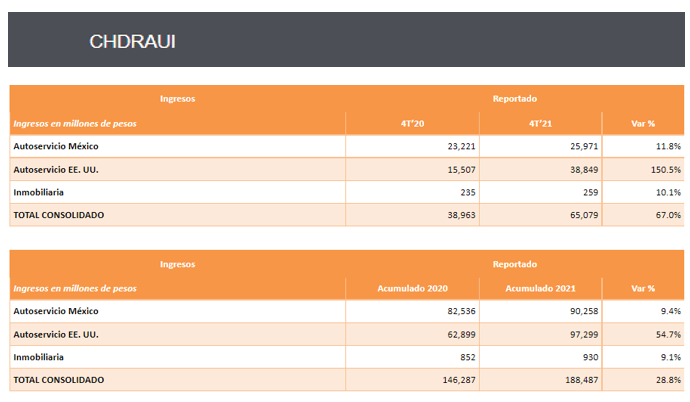

The Mexican company Chedraui reported more revenue from its self-service stores in the United States compared to Mexico in 2021.

While in the United States its income from this concept was 97,299 million pesos, in Mexico it totaled 90,258 million pesos.

At year-on-year rates, their corresponding revenues in the United States grew 54.7% and in Mexico they rose 9.4 percent.

For the fourth quarter of 2021, total sales of the United States Self-Service grew 150.5% year-on-year, accounting for 38,849 million pesos after the consolidation of the Smart & Final operation.

On a comparable basis, in dollars, same-store sales grew 11.5%; however, this last quarter of the year only 12 weeks were counted, unlike the fourth quarter of the previous year when 13 weeks were counted.

Chedraui

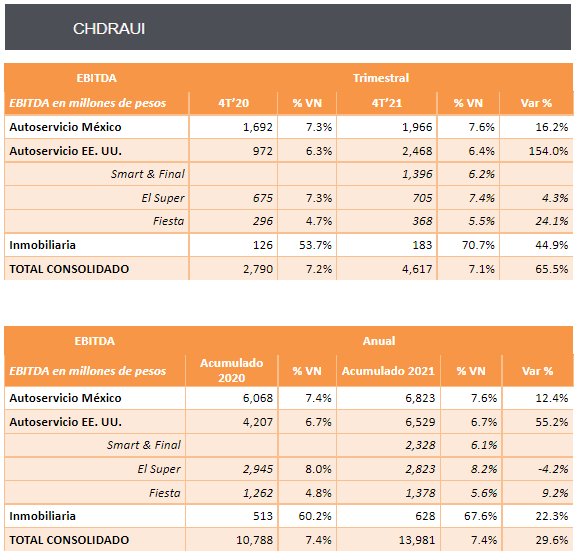

The consolidated EBITDA of Grupo Chedraui for the fourth quarter of 2021 grew 65.5% compared to the previous year, registering 4,617 million in the period, reaching a margin of 7.1 percent.

On a comparable basis, that is, excluding the consolidation of the Smart & Final operation, the Company’s EBITDA reached 3,222 million pesos, with a margin of 7.6%, equivalent to an expansion of 40 basis points year over year.

Meanwhile, Autoservicio México registered 1,966 million pesos in EBITDA in the period, with a margin of 7.6 percent.

On the part of United States Autoservice, the EBITDA generated in the period reached the amount of 2,468 million pesos, with a margin on sales of 6.4% and a year-on-year growth of 154.0 percent.

The El Super operation achieved a margin expansion of 3 basis points compared to the previous year thanks to the efficient management of operating expenses, while the Fiesta business continued its EBITDA margin expansion in line with the plan implemented since its acquisition, thus achieving an improvement in profitability of 75 basis points.

In the operation of Smart & Final, two effects influenced the obtaining of an EBITDA margin below the one organically reported in the previous quarter.

On the one hand, the natural seasonality of the business suffers from a higher proportion of operating expenses in the last quarter of the year.

On the other hand, an impact of around 7 million dollars was recorded in cost of sales derived from the revaluation of inventories resulting from the asset valuation process after the acquisition of the Company, a valuation that is made in the Purchase Price Allocation process. (PPP).

This effect is non-recurring and does not represent an outflow and was fully recorded this quarter.

During the fourth quarter of 2021, the company reached 65,079 million pesos in consolidated revenues, with a growth of 67.0% year-on-year and 9.2% on a comparable basis.

For the total of the year, consolidated sales grew 28.8% reaching 188,487 million pesos, and, excluding the operation of Smart & Final, 2.7 percent.

![]()