Between September 2021 and March 2022, base metal prices grew 25%, according to the Bloomberg Base Metals Spot Index.

Tata Motors highlights that metals prices have been steadily rising since December 2021, supported by stronger demand forecasts as well as limited supply due to disruptions in some major metal exporting countries.

Most metals reached multi-year highs as a result of the war, with aluminum and nickel leading the way.

During the fourth quarter of 2021 and January 2022, gold prices gradually increased and remained around $1,800 per troy ounce.

Meanwhile, bullion prices soared in February as a result of a further flight to safety, before reversing some of their gains in the second half of March 2022.

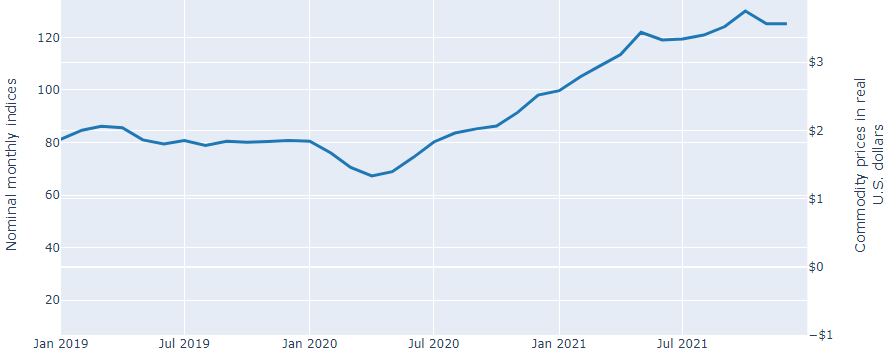

Base metals index and certain base metal price series, 2019–21

In retrospect, base metal prices fell in the first half of 2020, as the emergence of the Covid-19 pandemic depressed industrial activity and consumer demand worldwide.

However, prices rose sharply during the last few months of 2020 due to increased demand, a resurgence of industrial activity in China that increased metal consumption, lingering supply constraints related to the pandemic, and China’s large stockpiling of industrial raw materials.

According to the U.S. International Trade Commission (USITC), this trend continued into the first half of 2021, further boosting prices of widely used metals such as copper, aluminum, nickel, steel, zinc and tin.

Base metals

Increased demand for minerals and metals used in commercial construction, steel production, and the automotive and transportation industries was attributed to the recovery of economies after the slowdown in response to the onset of the pandemic.

The copper, iron ore, steel and zinc industries were particularly affected by increased demand from manufacturing.

Also, the increase in base metal prices was attributed in part to supply factors, such as cutbacks, electricity shortages, and China’s policies to reduce energy consumption and pollution from metal refining.

In addition, the USITC indicated that metal smelters around the world reduced production due to rising energy costs that drove up operating costs and regulatory pressure to reduce carbon emissions.

Zinc

Rising energy prices and a corresponding decline in metal production coincided with demand that was recovering from the initial slowdown at the onset of the Covid-19 pandemic.

For example, demand for zinc, which is used in steelmaking, was strong as economies around the world recovered and demand for automobiles and construction improved.

One of the largest price increases in the metals sector in 2021 was for nickel, when strong demand from China’s stainless steel industry, the main consumer of nickel, pushed up global prices.

The USITC exposed that policy decisions to curb the supply of some industrial materials and metal production in China, along with continued demand from emerging sectors such as metals used for renewable energy applications, also kept metal prices elevated through the end of 2021.

![]()