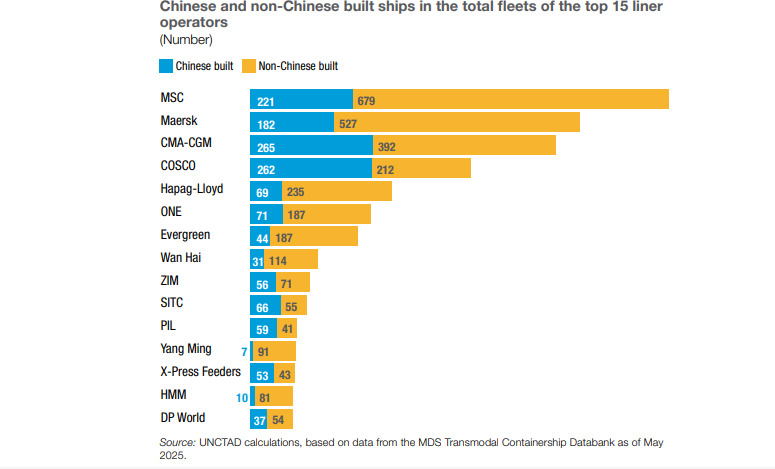

A UNCTAD report broke down the number of ships built in China for the total fleets of the world’s 15 leading shipping line operators.

Of MSC’s fleet, 221 ships were built in China and 679 ships were built in other countries. Of Maersk’s fleet, the figures were 182 and 527, in that order. And of CMA-CGM’s fleet, they were 265-392.

A shipping line is a company dedicated to maritime cargo transport. Its main activities are operating ships on international routes, managing port logistics, and offering multimodal transport services. In this way, it facilitates global trade through efficiency, connectivity, and standardization.

Ships built in China

Among the major shipping lines that dominate global container shipping are MSC, Maersk, CMA CGM, COSCO, Hapag-Lloyd, ONE, Evergreen, Wan Hai, ZIM, SITC, PIL, Yang Ming, X-Press Feeders, HMM, and DP World.

In February 2025, the U.S. Trade Representative published proposed measures under Section 301, including tariffs and restrictions on certain maritime transport services, followed by public consultations on these initiatives.

On April 17, 2025, final and additional measures under review were announced. These focus on port fees applicable to foreign vessels, especially operators and fleets linked to China, as well as vessels built in that country.

In particular, while the applicable fees are set at $0 for the first 180 days, in the first phase, beginning October 14, 2025, the following fees will apply: fees to Chinese ship owners and operators based on net tonnage, which will gradually increase in subsequent years; fees for operators of Chinese-built vessels based on net tonnage or containers, which will gradually increase in subsequent years; and fees for foreign-built car carriers based on their capacity.

Port fees

According to a preliminary analysis by Clarksons Research, it is estimated that 7% of calls at U.S. ports by ships trading internationally in 2024 would fall under the proposed revised port fee plan announced by the U.S. Trade Representative on June 6, 2025.

The estimate assesses calls at US ports affected by potential port fees, considering vessel type, routes, country of construction, and ownership. It includes car carriers, vessels built in China and operated or owned by China.

The estimate excludes calls by LNG carriers, according to Clarksons Research. Aggregate annual tariffs could reach between $5 billion and $13 billion.

Although they reflect potential costs, the figures are theoretical. They are based on 2024 maritime trade patterns. Actual totals could be lower due to possible vessel redistribution.