Woodside Petroleum Ltd (Woodside) and BHP Group (BHP) entered into a merger deed of commitment to combine their respective oil and gas portfolios through a merger of shares (the «Transaction») to create an independent top 10 global energy company by production. .

On the one hand, BHP is the world’s largest diversified natural resources company by market capitalization with more than 80,000 employees and contractors, primarily in Australia and the Americas.

BHP’s products are sold worldwide and it is among the world’s leading producers of major commodities, including iron ore, copper, nickel, and metallurgical coal.

Also BHP pioneered the development of an oil and gas industry in Australia with the discovery of the Bass Strait in 1965.

Now BHP’s oil business has conventional oil and gas assets in the United States Gulf of Mexico, Australia, Trinidad and Tobago, and Algeria, and exploration evaluation and options in Mexico, Trinidad and Tobago, western United States Gulf of Mexico, Eastern Canada and Barbados.

Crude oil and condensate, gas and natural gas liquids (NGL) produced by BHP’s oil assets are sold on the international spot market or on the domestic market.

The total value of gross assets of BHP’s oil business as of June 30, 2021 was US $ 15.4 billion, contributed US $ 3.9 billion to BHP Group revenue and generated an EBITDA of US $ 2.3 billion for the year ended June 30, 2021.

Woodside

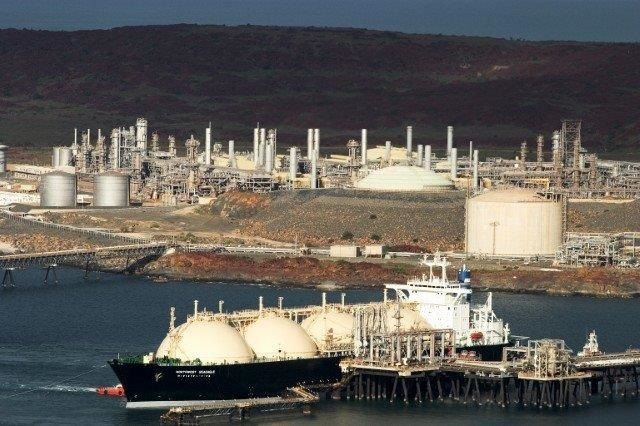

This company led the development of the LNG industry in Australia and is applying this same pioneering spirit to solve the energy challenges of the future.

With a focused portfolio, Woodside is recognized for its world-class capabilities as an integrated energy provider.

As Australia’s leading LNG operator, Woodside operated 6% of the world’s LNG supply in 2020.

Fusion

Upon completion of the Transaction, BHP’s oil and gas business would be merged with Woodside, and Woodside would issue new shares for distribution to BHP shareholders.

The expanded Woodside would be owned by 52% of current Woodside shareholders and 48% of existing BHP shareholders.

The Transaction is subject to confirmatory due diligence, the negotiation and execution of the transaction documents in full, and the fulfillment of the conditions precedent, including regulatory, shareholder and other approvals.

Combining two high-quality asset portfolios, the proposed merger would create the largest energy company listed on the ASX, with a global top 10 position in the LNG industry by production.

In addition, the combined company will have a high-margin oil portfolio, long-lived LNG assets and the financial resilience to help supply the energy needed for global growth and development during the energy transition.

![]()