Walmart de México y Centroamérica (Walmex) reported that its Prichos store format doubled its sales in 2024.

In its 2024 annual report, Walmex highlighted that it continues to work with key programs. Among them, the company has Los Básicos en tu Canasta, which maintains low prices on more than 100 essential products. It also strategically placed its Prichos store near the checkout area within 25 large-format Walmart stores, which allowed sales of Prichos products to double.

This also contributed to increased traffic and strengthened price perception at Supercenter.

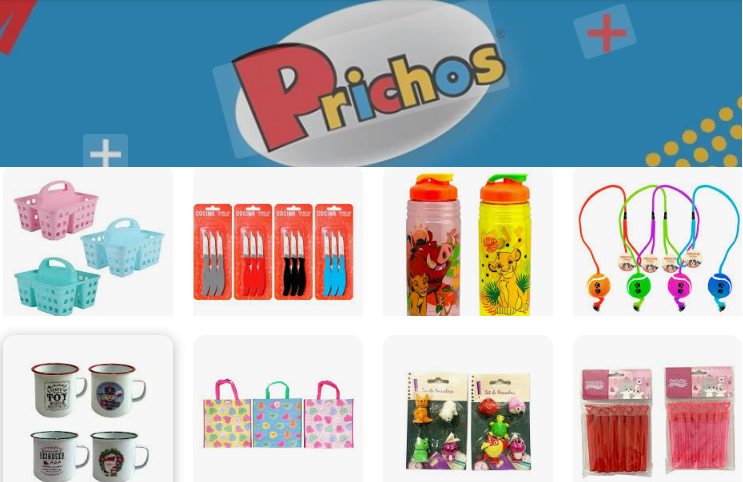

Prichos

In its stores Prichos kept the price of key products at 22 pesos for three years in 2024, “offering its customers a valuable solution at a stable and affordable price.” This approach resulted in a steadily growing NPS (Net Promoter Score, an indicator for measuring loyalty).

Currently, the commercial names of Walmex’s different business formats in Mexico, such as Bodega Aurrerá, Mi Bodega Aurrerá, Bodega Aurrerá Express, Prichos, Cashi and Bait, are brands owned by Wal-Mart de México, S.A.B. de C.V., as are the Aurrera, Medimart and Atvio brands.

Financial Results

In 2024, Walmex reported total revenues of Ps. 958.507 billion, an increase of 8.1 percent over 2023.

At the same time, the company achieved net income of 53.827 billion pesos, a year-on-year increase of 4.3 percent.

Walmart de México y Centroamérica is one of the most important retail chains in the region. As of December 31, 2024, it operated 4,079 units in 6 countries (Costa Rica, Guatemala, Honduras, El Salvador, Mexico, and Nicaragua), through self-service stores, membership price clubs, and omnichannel sales.

Own brands

The own-brand offering plays a key role in Walmart de México y Centroamérica’s Win at a Discount strategy. In addition, these brands have gained ground in consumer preferences. In 2024, almost 50% of customers purchased at least one private label item.

As a result, sales penetration increased by more than 50 basis points compared to the previous year. Sam’s Club’s Member’s Mark was a particular standout. This brand helped drive annual membership renewals. It also increased its sales share by 87 basis points versus last year.