Trade in services between Mexico and the United States went from a surplus to a U.S. deficit.

First, the U.S. economy recorded a surplus of US$2.7 billion in 2021 in this bilateral trade balance.

But then, the U.S. ran a deficit of $630 million in 2022, according to the latest available data.

These services include, among others:

- Tourism.

- Transportation.

- Information technology.

- Financial services.

- Consulting.

- Education.

- Engineering.

- Environmental services.

Trade in services

U.S. services exports to Mexico increased from $30.5 billion in 2021 to $37.7 billion in 2022.

Conversely, U.S. imports increased from $27.8 billion to $38.3 billion.

Globally, according to data from the World Trade Organization (WTO), Mexico climbed from 23rd position in 2022 to 18th in 2023 among the largest exporters of commercial services.

In 2023, these Mexican foreign sales increased 9% at an annual rate, reaching US$52 billion.

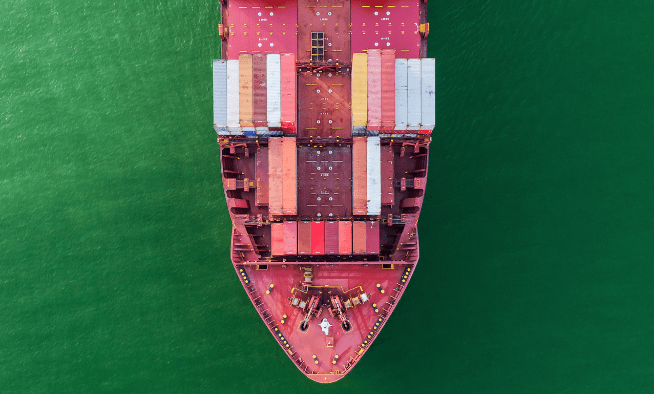

Merchandise trade

Mexico ranked as the top foreign supplier to the United States in merchandise trade in 2023, ahead of China and Canada.

According to a U.S. congressional analysis, U.S. merchandise imports from Mexico increased from $39.9 billion in 1993 to $475.6 billion in 2023.

The top U.S. merchandise imports from Mexico in 2023 included motor vehicles ($85 billion), motor vehicle parts ($66.3 billion), computer equipment ($28.6 billion), oil and gas ($19.8 billion), and electrical equipment ($18.8 billion).

On the other hand, exports of goods from the United States to Mexico increased from US$41.6 billion in 1993 to US$323.2 billion in 2023.

Trade integration

Mexico, the United States and Canada have increased their trade integration driven by the North American Free Trade Agreement (NAFTA), which came into force in January 1994.

This agreement was later replaced by the Treaty between Mexico, the United States and Canada (USMCA) as of July 2000.

The USMCA seeks to strengthen North America’s competitiveness in global trade.