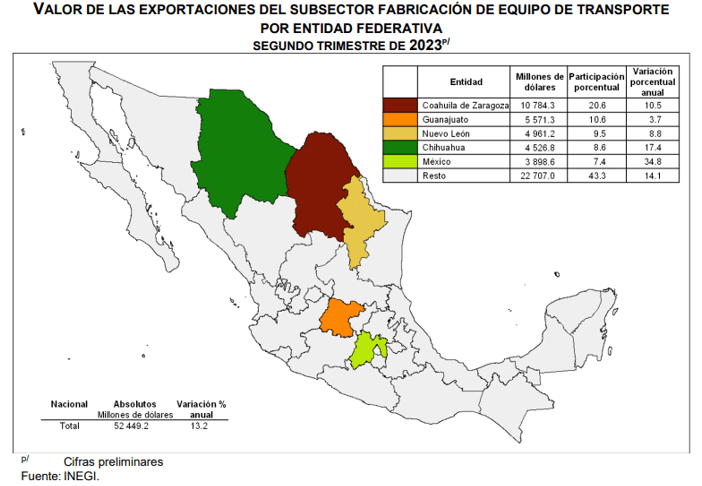

The Mexican states with the highest exports of products in the Transportation equipment manufacturing subsector were Coahuila, Guanajuato, Nuevo León, Chihuahua and Mexico.

Coahuila recorded exports of 10.784 billion dollars in the second quarter of 2023, a year-on-year increase of 10.5%, according to Inegi data.

This was followed by Guanajuato (5,571 million dollars, +3.7%), Nuevo Leon (4,961 million, +8.8%), Chihuahua (4,527 million, +17.4%) and State of Mexico (3,899 million, +34.8%).

Among the branches of this productive subsector are the manufacture of automobiles and light motor vehicles, heavy-duty trucks, motor vehicle bodies, truck trailers, motor homes, travel trailers and caravans, motors, electrical and electronic equipment for motor vehicles, and steering and suspension components for motor vehicles.

Together, the five states referred to accounted for 56.7% of the exports registered in the subsector.

To compile this statistic, Inegi relied on data from the Mexican Statistical and Business Registry (RENEM); Economic Census; Mexican Merchandise Trade Balance; Monthly and Annual Survey of the Manufacturing Industry (EMIM/EAIM), and Monthly Statistics of the Manufacturing, Maquiladora and Export Services Industry Program (IMMEX).

Transportation Equipment

Inegi also used data from the Mining and Metallurgical Industry Statistics (EIMM) and Annual Module for Companies in the Agricultural, Manufacturing, Commercial and Services Sector; the National Hydrocarbons Commission; and Administrative Records of the National Hydrocarbons Commission.

Although automotive industry production has recovered modestly, it remains well below recent historical levels.

Automotive production increased 7% in 2022 compared to 2021 and is expected to increase 3% in 2023 compared to 2022, according to January 2023 projections from S&P Global Mobility, formerly IHS Markit.

Overall, global industrial production in 2022 was approximately 8% below pre-pandemic 2019 levels and 16% below peak 2017 levels.

Since 2020, according to Lear Corporation, industrial and economic conditions have been influenced directly and indirectly by macroeconomic events such as the Covid-19 pandemic and, beginning in the first quarter of 2022, the conflict between Russia and Ukraine, resulting in unfavorable conditions, including shortages of semiconductor chips and other components, elevated inflation levels, higher interest rates, and labor and energy shortages in certain markets.