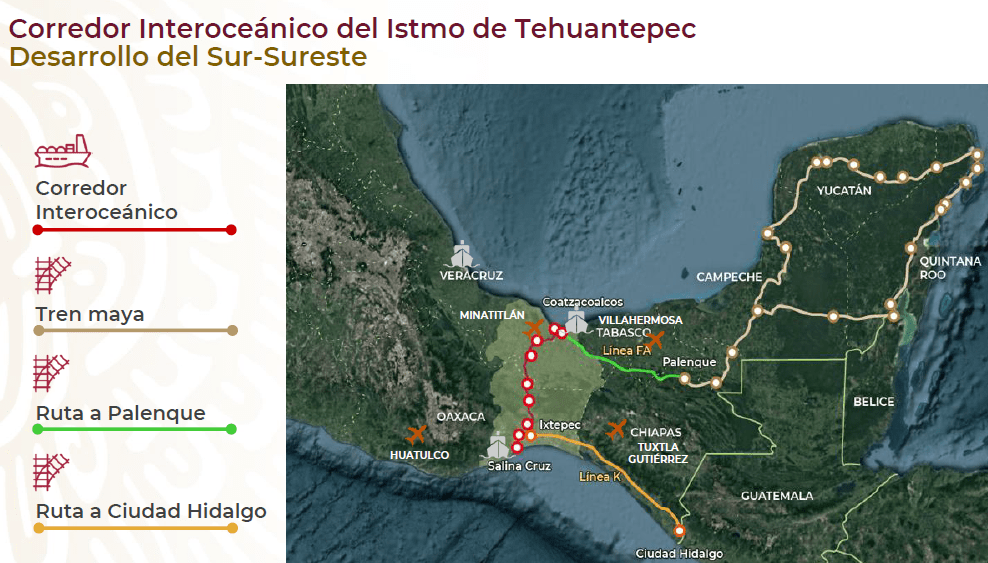

The Ministry of Economy announced three tax incentives that the federal government will give to companies that set up in the development poles of the Inter-Oceanic Corridor of the Isthmus of Tehuantepec (CIIT).

To begin with, the Ministry of Finance and Public Credit (SHCP) will grant accelerated depreciation during the first six years of operation.

Secondly, a VAT exemption will be granted on transactions within and between the poles during the first four years, and VAT recovery will be allowed on purchases made outside the development poles.

Finally, there will be a 100% income tax (ISR) discount during the first three years of operation. In addition, 50% will be granted in the following three years; however, if the companies exceed the employment goals, the discount may be up to 90%.

Tax incentives

Mexico’s federal tax structure includes both direct taxes, mainly in the form of income taxes, and indirect taxes, mainly in the form of Value Added Tax (VAT) and special taxes, such as the Special Tax on Products and Services (IEPS).

While Mexican VAT is levied at two fixed rates: 8% in the Northern Border Free Zone and 16% for the rest of the country, VAT is passed through the manufacturing and distribution chain and is passed on as part of the purchase price to the consumer.

On December 30, 2020, a presidential decree was published extending until 2024 the validity of both the 8% VAT and the tax credit equivalent to one third of the income tax accrued in the Northern Border Free Trade Zone.

On the same day, another presidential decree also extended until 2024 the 8% VAT and the tax credit equivalent to one third of the income tax accrued in certain municipalities of the southern border.

Other current support

The IMMEX is an instrument to promote exports that may be used by companies that import goods on a temporary basis and that carry out an industrial or service process intended for manufacturing, transformation or repair and/or the rendering of export services.

In addition, IMMEX offers the possibility of importing goods under a temporary regime, deferring the payment of the general import tax, VAT and, if applicable, the countervailing duties.

On the other hand, the Sector Promotion Programs are aimed at companies that produce certain goods, through which they are allowed to import at preferential tariffs various goods to be used in the production of specific products, regardless of whether the goods to be produced are destined for export or for the domestic market.

The Mexican government grants specific incentives, such as for electromobility, medical and electrical equipment and the electronics industry.

Temporary imports are also duty free (0%) on goods to produce export items.

Another incentive is the ISAN exemption for the final export of automobiles and the sale of electric, hybrid or hydrogen-powered vehicles.

The regional content value for application of the USMCA is 60 to 75% in the case of electric vehicles.