The United States, China and Hong Kong ranked as the largest recipients of FDI in the world in 2021, according to an UNCTAD report.

Singapore, Canada, Brazil, India, South Africa, Russia and Mexico followed.

In total, global FDI flows in 2021 were $1.58 trillion, 64% higher than the level during the first year of the Covid-19 pandemic, of less than $1 trillion.

FDI flows appeared to have a significant boost mainly due to the boom in mergers and acquisitions (M&A) markets and rapid growth in international project finance as a result of flexible financing conditions and significant infrastructure stimulus packages.

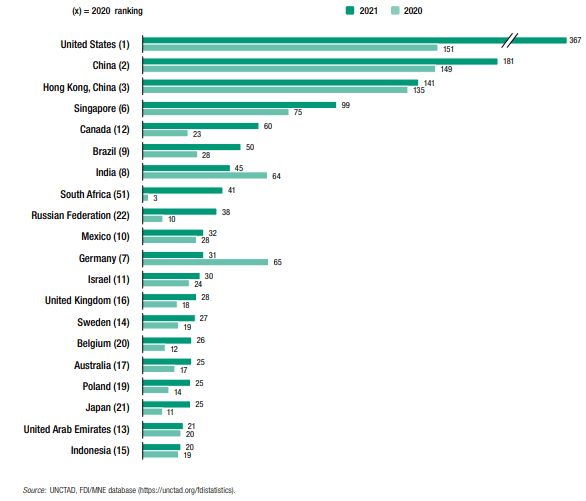

FDI in¬ows, top 20 host economies, 2020 and 2021 (Billions of dollars)

However, the global environment for international business and cross-border investment changed dramatically in 2022 with the start of the war in Ukraine, which occurred while the world was still recovering from the impact of the pandemic.

According to UNCTAD, the war is having effects far beyond its immediate vicinity, causing a triple food, fuel and financial crisis, with rising energy and commodity prices driving inflation and worsening debt spirals.

Recipients of FDI

Investor uncertainty and risk aversion could put significant downward pressure on global FDI in 2022.

The war, with its direct implications for investment in and from the Russian Federation and Ukraine, and its ripple effects through sanctions, energy and commodity supply shortages, and broader macroeconomic impact, is not the only factor cools FDI prospects for 2022.

The upsurge of the Covid-19 pandemic in China, which is causing new lockdowns in some areas that play an important role in global value chains (GVCs), could further depress new investments in new industries in GVC-intensive industries.

In addition, expected increases in interest rates in the United States, Europe and other major economies that are experiencing significant increases in inflation could slow M&A markets later in the year and curb project finance growth. international.

![]()