Telefónica and AT&T beat América Móvil in their market share in Mexico‘s mobile telephony service in 2021 compared to 2020.

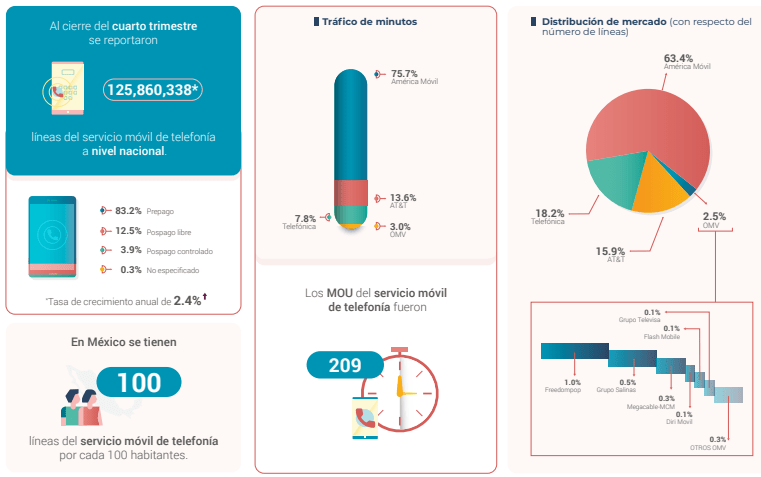

After having 7.5 percent coverage in 2020 in this indicator, Telefónica increased its share to 18.2 percent.

AT&T also had an upward trend, from 13.7 to 15.9 percent.

In 2021, Mexico counted 123.9 million cell phone lines; penetration has increased since 2017 approaching 100 percent.

Earlier, in 2020 the pandemic sparked an increase in demand for fixed broadband to perform remote activities; penetration reached 64 percent in 2020, and continued to increase in 2021.

Telefónica and AT&T

To provide telecommunications services, a single concession is required, granted by the IFT, for commercial use (30 years renewable); this concession allows the provision of all types of services (including broadcasting).

The IFT also grants authorizations (10 years, renewable), for mobile virtual network operators (MVNOs), which operate in the mobile telecommunications market.

Between 2017 and 2022 the development of Red Compartida encouraged the entry of several MVNOs into the market.

Mexico is the third largest market in the region for MVNOs. All operators (fixed and mobile) offer portability.

At the end of the fourth quarter of 2022, 125 million 860,338 mobile telephony service lines were reported nationwide.

In contrast, América Móvil reduced its market share in Mexico’s mobile telephony service from 78.1% in 2020 to 63.4% in 2021.

As for MVNOs, their share went from 0.7 to 2.5 percent.

MVNOS

Around the world, these operators are playing a fundamental role in bringing services closer to those market niches that are usually considered unprofitable for traditional operators.

According to the IFT, solutions range from low-cost packages for IoT with a cost of 1 euro per connected device, as well as solutions for immigrants in disadvantaged situations or the so-called SIM-only plans, which for a fixed monthly cost access a package of data, calls and SMS without a forced term with the freedom to change company or tariff plan without some kind of penalty.

These types of offers use freemium schemes where the user does not pay for the basic service, but if he/she is looking for more data or calls, he/she must pay to upgrade his/her basic tariff plan. In general, this analysis explores this and other marketing trends in the MVNO ecosystem.