Oil demand to increase in the medium term: IEA

Globally, oil demand is expected to increase in the medium term, with the International Energy Agency (IEA) forecasting growth of 1.7 million barrels per day

Globally, oil demand is expected to increase in the medium term, with the International Energy Agency (IEA) forecasting growth of 1.7 million barrels per day

The Repsol Group, whose parent entity is Repsol, S.A., is made up of more than 300 entities incorporated in 36 countries. This is its view

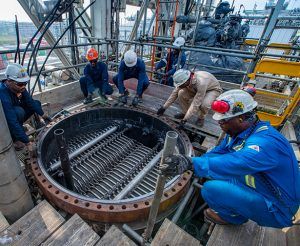

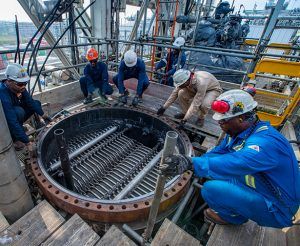

The company Tenaris, a subsidiary of the Techint Group, highlighted that drilling activity related to the energy industry is increasing throughout the world. During the

As a further consequence of the strong recovery and the current imbalance between supply and demand, commodity prices soared in 2021 and are still high.

Energy prices rose in the second half of 2021 and are currently forecast to be much higher in 2022 than expected, according to World Bank

The increase in the prices of raw materials was the main explanatory factor for the rebound in exports from Latin America and the Caribbean in

The Asian Development Bank (ADB) indicated upside and downside risks in world oil prices for 2022. For the next year, the ADB expects oil prices

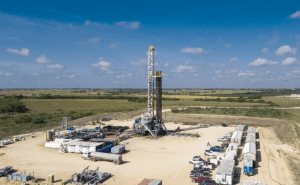

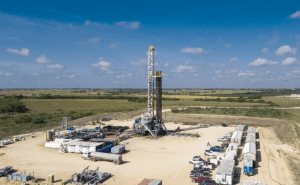

The demand for onshore oil platforms in the United States registered a decrease of 54.3% in 2020 on the basis of 2019, the company Helmerich

Aviation has begun to contribute to pushing oil prices up, with the continuous improvement of flights after the collapse of that industry due to the

Pemex’s export sales to the United States amounted to 303.8 billion pesos in 2020, representing 31.9% of its total sales and 68.2% of its export

Globally, oil demand is expected to increase in the medium term, with the International Energy Agency (IEA) forecasting growth of 1.7 million barrels per day

The Repsol Group, whose parent entity is Repsol, S.A., is made up of more than 300 entities incorporated in 36 countries. This is its view

The company Tenaris, a subsidiary of the Techint Group, highlighted that drilling activity related to the energy industry is increasing throughout the world. During the

As a further consequence of the strong recovery and the current imbalance between supply and demand, commodity prices soared in 2021 and are still high.

Energy prices rose in the second half of 2021 and are currently forecast to be much higher in 2022 than expected, according to World Bank

The increase in the prices of raw materials was the main explanatory factor for the rebound in exports from Latin America and the Caribbean in

The Asian Development Bank (ADB) indicated upside and downside risks in world oil prices for 2022. For the next year, the ADB expects oil prices

The demand for onshore oil platforms in the United States registered a decrease of 54.3% in 2020 on the basis of 2019, the company Helmerich

Aviation has begun to contribute to pushing oil prices up, with the continuous improvement of flights after the collapse of that industry due to the

Pemex’s export sales to the United States amounted to 303.8 billion pesos in 2020, representing 31.9% of its total sales and 68.2% of its export