Imports from Mexico drop 22.2% in June

Imports from Mexico dropped 22.2% year-on-year in June, to $ 27,529.8 million, the Inegi reported. This rate was the result of decreases of 31.2% in

Imports from Mexico dropped 22.2% year-on-year in June, to $ 27,529.8 million, the Inegi reported. This rate was the result of decreases of 31.2% in

The peso begins the session with an appreciation of 0.78% or 17.4 cents, trading around 22.11 pesos per dollar, before a general weakening of the

Mexico’s exports (merchandise) registered a year-on-year drop of 12.8% in June, to $ 33,076.5 million, the Inegi reported. This rate originated from reductions of 11.6%

The peso begins the session with a depreciation of 0.40% or 9.03 cents, trading around 22.46 pesos per dollar, after the weekly employment report for

The peso begins the session with an appreciation of 0.70% or 15.8 cents, trading around 22.33 pesos per dollar, as a greater appetite for risk

The peso closed the week with a depreciation of 0.56% or 12.5 cents, trading around 22.57 pesos per dollar, hitting a minimum of 22.2562 and

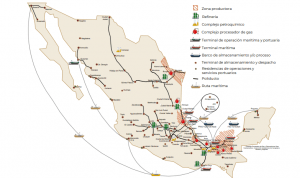

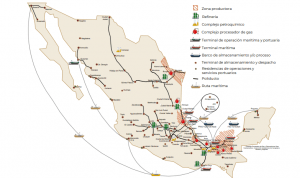

Pemex highlighted that the information technology area contributed to the best logistics and that of its Subsidiary Productive Companies (EPS) during 2019, in various areas:

The peso closed the session with a depreciation of 0.47% or 10.5 cents, trading around 22.43 pesos per dollar, given a deterioration in sentiment in

The peso begins the session with little change, showing a depreciation of 0.12% or 2.7 cents and trading around 22.35 pesos per dollar, given a

The peso closed the session with an appreciation of 0.59% or 13.2 cents, trading around 22.31 pesos per dollar, before a return of risk appetite

Imports from Mexico dropped 22.2% year-on-year in June, to $ 27,529.8 million, the Inegi reported. This rate was the result of decreases of 31.2% in

The peso begins the session with an appreciation of 0.78% or 17.4 cents, trading around 22.11 pesos per dollar, before a general weakening of the

Mexico’s exports (merchandise) registered a year-on-year drop of 12.8% in June, to $ 33,076.5 million, the Inegi reported. This rate originated from reductions of 11.6%

The peso begins the session with a depreciation of 0.40% or 9.03 cents, trading around 22.46 pesos per dollar, after the weekly employment report for

The peso begins the session with an appreciation of 0.70% or 15.8 cents, trading around 22.33 pesos per dollar, as a greater appetite for risk

The peso closed the week with a depreciation of 0.56% or 12.5 cents, trading around 22.57 pesos per dollar, hitting a minimum of 22.2562 and

Pemex highlighted that the information technology area contributed to the best logistics and that of its Subsidiary Productive Companies (EPS) during 2019, in various areas:

The peso closed the session with a depreciation of 0.47% or 10.5 cents, trading around 22.43 pesos per dollar, given a deterioration in sentiment in

The peso begins the session with little change, showing a depreciation of 0.12% or 2.7 cents and trading around 22.35 pesos per dollar, given a

The peso closed the session with an appreciation of 0.59% or 13.2 cents, trading around 22.31 pesos per dollar, before a return of risk appetite