China neutralizes the impact of US tariffs

China managed to more than neutralize the impact of US tariffs, at least in the first seven months of 2025, according to a report by

China managed to more than neutralize the impact of US tariffs, at least in the first seven months of 2025, according to a report by

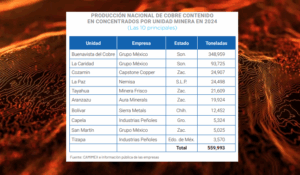

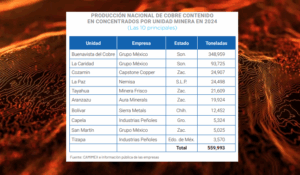

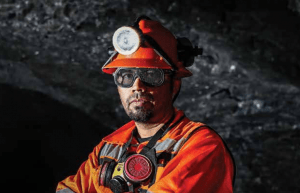

Grupo México tops the list of the main copper mining units in Mexico, based on its production in 2024. According to data from the Mexican

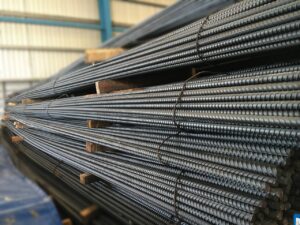

Deacero called for restarting steel companies in the USMCA if they use inputs produced in North America. In its opinion, North America must present a

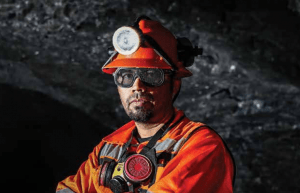

A study by the Center for Economic Research and Teaching (CIDE) highlighted that mining in Mexico has created 14 million jobs and that this activity

Mexico has lost share of total products imported into Colombia, while China has increased its share of that market. In 2024, Colombian imports of goods

Mexico ranked as the top destination for U.S. metallic mineral exports in the first five months of 2025, displacing Canada to second place. Considering full

Tariffs on Brazilian steel imports to the United States have a low impact in volume, but high in value. In 2024, Brazil exported $2.911 billion

Foreign investment in Mexican mining (extraction of metallic metals) fell at a year-on-year rate of 82.8% in 2024, to US$360 million, according to data from

FDI in metallic mineral mining in Mexico recorded a year-on-year drop of 82.8% in 2024, to US$360 million, according to data from the Ministry of

Tariffs between the United States and Brazil have been the subject of questioning between the governments of both nations. An initial fact to ponder: The

China managed to more than neutralize the impact of US tariffs, at least in the first seven months of 2025, according to a report by

Grupo México tops the list of the main copper mining units in Mexico, based on its production in 2024. According to data from the Mexican

Deacero called for restarting steel companies in the USMCA if they use inputs produced in North America. In its opinion, North America must present a

A study by the Center for Economic Research and Teaching (CIDE) highlighted that mining in Mexico has created 14 million jobs and that this activity

Mexico has lost share of total products imported into Colombia, while China has increased its share of that market. In 2024, Colombian imports of goods

Mexico ranked as the top destination for U.S. metallic mineral exports in the first five months of 2025, displacing Canada to second place. Considering full

Tariffs on Brazilian steel imports to the United States have a low impact in volume, but high in value. In 2024, Brazil exported $2.911 billion

Foreign investment in Mexican mining (extraction of metallic metals) fell at a year-on-year rate of 82.8% in 2024, to US$360 million, according to data from

FDI in metallic mineral mining in Mexico recorded a year-on-year drop of 82.8% in 2024, to US$360 million, according to data from the Ministry of

Tariffs between the United States and Brazil have been the subject of questioning between the governments of both nations. An initial fact to ponder: The