Commodity market trend

The commodity rally that began in 2021 and continued through the first half of 2022 subsided in the second half of 2022 and into 2023.

The commodity rally that began in 2021 and continued through the first half of 2022 subsided in the second half of 2022 and into 2023.

Intercam Banco published on Tuesday an analysis of the outlook for gold, silver, copper and zinc prices, which have shown strength. December saw another extension

International commodity prices registered a mixed behavior, with episodes of volatility, during the second quarter of 2022, referred the Bank of Mexico (Banxico). To begin

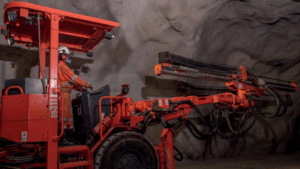

Mining in Mexico will attract 5,539 million dollars in 2022, an increase of 15.2% compared to 2021, estimated the Mining Chamber of Mexico (Camimex). In

Energy prices used in the S&P Goldman Sachs Commodity Index (GSCI) ended 2021 59% higher than the first trading day of the year, the Energy

Mining production contributed 81.1% of world silver supply in 2020, according to information from Fresnillo plc. The world’s silver supply comes mainly from two sources:

The peso starts the session with few changes compared to Thursday’s closing, showing a depreciation of 0.02%, trading around 19.70 pesos per dollar, with the

The Mexican peso begins the session with an appreciation of 0.46% or 8.3 cents, trading around 20.08 pesos per dollar, with the exchange rate touching

The peso starts the session with a depreciation of 0.08% or 1.7 cents, trading around 19.97 pesos per dollar, with the exchange rate touching a

The Mexican peso closed the week with an appreciation of 1.15% or 23.2 cents, trading around 19.93 pesos per dollar, being the third consecutive week

The commodity rally that began in 2021 and continued through the first half of 2022 subsided in the second half of 2022 and into 2023.

Intercam Banco published on Tuesday an analysis of the outlook for gold, silver, copper and zinc prices, which have shown strength. December saw another extension

International commodity prices registered a mixed behavior, with episodes of volatility, during the second quarter of 2022, referred the Bank of Mexico (Banxico). To begin

Mining in Mexico will attract 5,539 million dollars in 2022, an increase of 15.2% compared to 2021, estimated the Mining Chamber of Mexico (Camimex). In

Energy prices used in the S&P Goldman Sachs Commodity Index (GSCI) ended 2021 59% higher than the first trading day of the year, the Energy

Mining production contributed 81.1% of world silver supply in 2020, according to information from Fresnillo plc. The world’s silver supply comes mainly from two sources:

The peso starts the session with few changes compared to Thursday’s closing, showing a depreciation of 0.02%, trading around 19.70 pesos per dollar, with the

The Mexican peso begins the session with an appreciation of 0.46% or 8.3 cents, trading around 20.08 pesos per dollar, with the exchange rate touching

The peso starts the session with a depreciation of 0.08% or 1.7 cents, trading around 19.97 pesos per dollar, with the exchange rate touching a

The Mexican peso closed the week with an appreciation of 1.15% or 23.2 cents, trading around 19.93 pesos per dollar, being the third consecutive week