Worldwide, overcapacity is affecting the shipbuilding sector, although the number of active shipyards in 2022 was 301 compared to a peak of 699 in 2007, according to a U.S. congressional analysis.

Shipbuilding ranges from small vessels to the manufacture of large cargo ships, cruise ships and military vessels.

In terms of tonnage delivered in 2022, dry bulk carriers took the lead, followed by tankers and container ships.

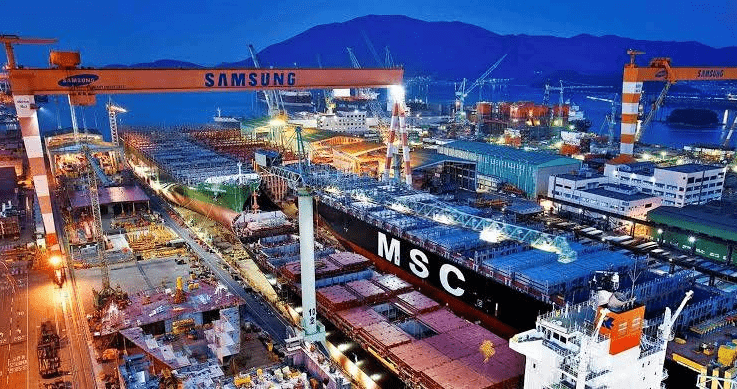

UNCTAD reports that China, the Republic of Korea and Japan were the main shipbuilding countries, accounting for 93% of the total tonnage delivered.

The U.S. Congressional analysis states that the three largest shipbuilding companies in China, Korea and Japan (nine companies in total) account for 75% of the world’s shipbuilding capacity.

Current shipyard capacity worldwide is approximately 1,200 to 1,300 ships per year, compared to approximately 2,000 ships per year between 2005 and 2010.

Shipbuilding

Over the years, the expansion of global shipping capacity has experienced ups and downs, reflecting economic cycles and trends in shipping, shipbuilding and financing.

Between 2005 and 2010, the average annual growth in global deadweight tonnage was 7.1 percent.

However, the same analysis adds, reflecting the 2007-2008 financial crisis, growth has slowed to an average of 4.9 percent between 2011 and 2023 due to, among other factors, shipbuilding consolidation and a shrinking ship financing market.

Since the pandemic, foot growth has slowed further, averaging 3.1% per year.

Profitability

In 2022, the European Commission ruled out merger plans between Korean shipbuilders Hyundai and Daewoo on the grounds that such plans would create a monopoly for LNG tanker construction.

Despite consolidation, even the most successful Korean and Japanese shipbuilding companies often operate at a loss.

Korean and Japanese shipbuilders are traditionally part of large manufacturing and financial conglomerates (e.g., Samsung, Hyundai, Mitsubishi, Kawasaki), where other profitable segments can help weather the poor profitability of their shipbuilding sector.