Shell and BP led the way in fossil asset divestments, according to data from the United Nations Conference on Trade and Development (UNCTAD).

Driven by climate objectives, reputational risks and financial considerations, major multinational energy companies have committed to prioritize decarbonization strategies and reduce their dependence on fossil fuel assets.

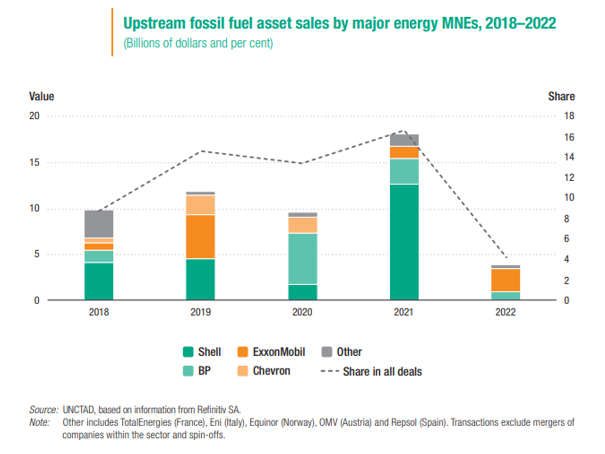

Over the past five years, energy multinational companies in UNCTAD’s Top 100 ranking have been divesting fossil fuel assets at a rate of about $15 billion each year, with Shell (UK) and BP (UK) leading the trend.

Divestments peaked in 2021, when sales of fossil fuel assets by the top eight multinational energy companies accounted for more than 16% of the total value of oil and gas asset trading.

But UNCTAD said this divestment trend reversed last year, as the major oil companies slowed sales in light of high energy prices.

Shell and BP

Divestment does not mean that oil fields, gas plants and other upstream assets will cease to operate.

The party that buys what the large energy companies sell usually tries to make that asset generate the highest possible return.

This usually means improving the overall productivity of the fossil fuel asset, including pushing for increased production or extended life.

Another concern is that buyers often have lower or non-existent emission reduction targets and weaker climate reporting standards, such as for private (unlisted) or smaller companies.

This would make it difficult to track oil and gas emissions, slowing the energy transition.

Trend

The proportion of unlisted investors in fossil fuel assets increased between 2016 and 2020, although transactions by large oil and gas companies reversed the trend in 2021 and 2022.

The trend could be underestimated, considering that private transaction values are often not disclosed.

Two-thirds of the private investors are investment and management companies, funds and private equity firms.

They also include smaller independent energy companies (in about 20% of cases) and commodity traders such as Trafigura (Singapore) or Vitol (Switzerland).

For example, some of the largest sales that major multinational oil and gas companies closed in recent years include Shell’s sale of North Sea assets to private equity firm EIG Energy Partners (United States) for $3.8 billion in 2017 and ExxonMobil’s sale of its North Sea assets to private equity group HitecVision (Norway) for $1.3 billion in 2021.