Private consumption in Mexico has grown at a moderate pace, driven by the recovery in the consumption of services, according to Inegi and the Bank of Mexico (Banxico).

At the end of 2022, Mexico’s GDP continued to advance, albeit with a deceleration from the performance observed in the first three quarters of 2022.

At the beginning of 2023, domestic economic activity continued to grow and remained resilient in the face of a complex external environment.

Regarding external demand, in the two-month period January-February 2023, the value of manufacturing exports decelerated, mainly associated with the performance of the automotive component.

Regarding the evolution of domestic demand, Banxico reports that in December 2022 private consumption continued to grow at a moderate pace, driven by the recovery in the consumption of services.

Gross fixed investment showed a better performance as a result, to a large extent, of the reactivation of the construction sector.

Private consumption

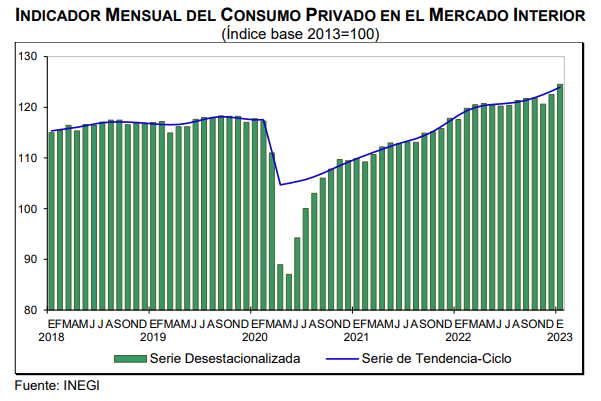

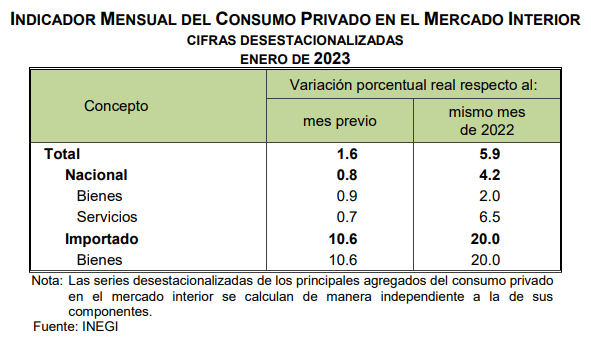

In January 2023 and with seasonally adjusted figures, the Monthly Indicator of Private Consumption in the Domestic Market (IMCPMI) increased, in real terms, 1.6 % at a monthly rate.

To clarify the indicator: the IMCPMI measures the behavior of spending by the country’s resident households on consumer goods and services, both of domestic and imported origin. Purchases of homes or valuables are excluded.

Most economic series are affected by seasonal and calendar factors.

Adjusting the data for these factors makes it possible to obtain seasonally adjusted figures. Their analysis helps to make a better diagnosis of the evolution of the variables.

According to the SHCP, private consumption registered real growth of 2.8% in 2022, despite inflationary pressures and tighter financial conditions.

Services

This was driven by the strength of the labor market, the gradual recovery of real disposable income, as well as the use of savings accumulated from the pandemic fiscal stimulus and the support of consumer credit.

On the other hand, in 2022 there was a higher demand for services with a real growth of 4.5% per year, while the goods segment contracted 0.5% in the same period, due to the return to pre-pandemic consumption patterns.

However, in January 2023, real spending on durable goods grew 5.2% from the previous month, seasonally adjusted, after two months of consecutive declines, and remained 27.3% above its pre-pandemic level, suggesting greater resilience to the Fed’s monetary policy interest rate hike.

Meanwhile, at home, key sectors for Mexico such as electronics, home appliances and transportation equipment grew 1.7%, 3.7% and 11.9%, respectively, in their real monthly variation in January 2023.