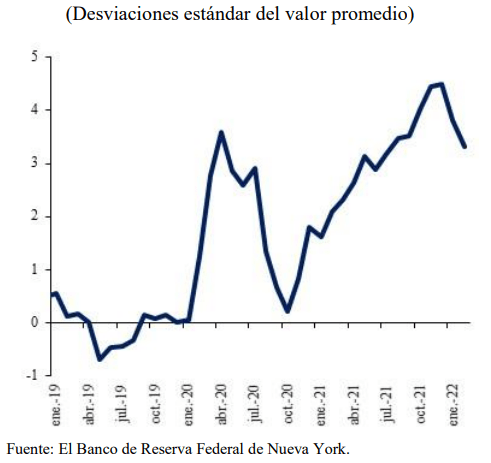

Disruptions in the global supply chain peaked at the end of 2021, according to the New York Federal Reserve‘s Global Supply Chain Pressures Index.

From the perspective of the Financial System Stability Council (CESF) of Mexico, the recovery of world trade during the first half of 2021 reflected a rotation of world demand towards manufactured goods whose production requires a great commercial intensity, especially durable goods from Asia.

Global Supply Chain Pressures Index

At the same time, the international trade volume index calculated by the Netherlands Bureau for Policy Analysis (CPB Netherlands) showed that the world trade volume grew by 10.3% in December 2021 compared to December of the previous year, with seasonally adjusted figures; while world exports increased 9.8% for the same period with seasonally adjusted figures.

The advanced economies increased their exports by 8.9%, and the emerging economies did so by 11.6 percent.

Then, towards the middle of 2021, world trade exhibited a moderation due to the slowdown in the growth of the demand for goods, together with the depletion of the inventories of companies after these were used to satisfy the rebound in demand in the first half of 2021.

For the CESF, the bottlenecks in the supply chains and the problems in the global supply of certain goods that were exacerbated in the second half of 2021 significantly affected emerging countries whose economic structure is highly linked to foreign trade and additionally contributed to high levels of inflation globally.

Supply chain

According to the World Bank in the Global Economic Outlook document of January 2022, the effects on the global supply chain, as well as the frictions in the labor markets, will gradually dissipate throughout 2022 as there is a greater capacity of the society to cohabit with the virus, mobility restrictions are eased, demand for services recovers, and factories can return to full capacity.

Likewise, it anticipates that the inflationary pressures caused by the disruption of the supply chain will gradually reduce towards the second half of 2022.

However, there are risks to this scenario. The shortage of inputs in the global supply chain could be aggravated by new waves of Covid-19 variants, such as the last one, driven by the Omicron variant, which generate new restrictions on mobility and commercial interruptions, as well as by the various effects derived from of the war between Russia and Ukraine.

If these persist for a prolonged period, they would generate additional disturbances in international trade that would hinder economic recovery and favor greater inflationary pressures.

![]()