PET imports from Brazil from Peru gave rise to the start of a possible dispute resolution panel within the framework of the World Trade Organization (WTO).

On Thursday, Peru requested consultations with Brazil in the framework of the WTO regarding the definitive anti-dumping measures imposed on ethylene polyterephthalate (PET) films and the tax treatment of imported products in general, through the application of the industrial products tax (IPI).

The request was circulated to WTO Members on July 15.

Peru claims that the anti-dumping measures imposed on PET films appear to be inconsistent with various provisions of the Agreement on the Implementation of Article VI of the General Agreement on Tariffs and Trade of 1994 (Anti-Dumping Agreement) of the WTO.

It also argues that the tax treatment given to imports with the application of the tax on industrial products (IPI) appears to be incompatible with the national treatment obligation provided for in Articles III: 2 and III: 4 of the GATT 1994.

The request for consultations formally initiates a dispute in the WTO. The consultations give the parties an opportunity to discuss the issue and find a satisfactory solution without reaching litigation.

After 60 days, if the consultations have not resolved the dispute, the claimant may request that a panel resolve it.

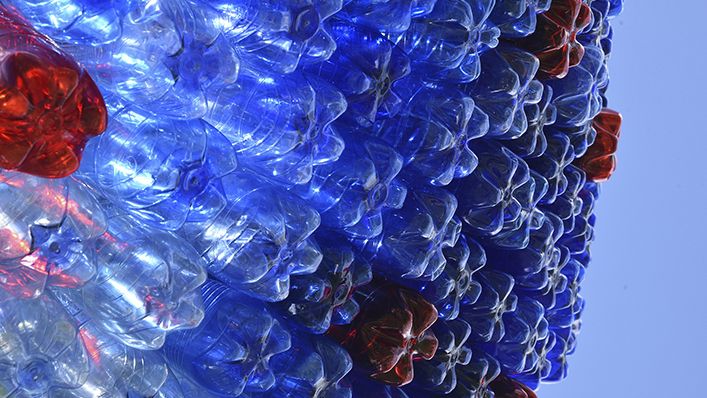

PET imports

The measures at issue are:

First measure

The definitive anti-dumping measures imposed by virtue of Portaria No. 473 of the Special Secretariat for Foreign Trade and International Affairs of the Ministry of Economy, dated June 28, 2019, published on July 1, 2019 in the Official Gazette of Brazil, as well as the decision to initiate the investigation, contained in Circular No. 68 of December 29, 2017, published on January 2, 2018, of the Ministry of Foreign Trade, including, among others, but not exclusively, its corresponding support reports, the relevant determinations, decisions regarding the confidentiality of information, as well as other aspects of the investigation related to the imposition of anti-dumping measures.

Second Measure

The practice of the Brazilian competent authority not to require with the request for the initiation of investigation the presentation of evidence regarding domestic sales in the country of origin or export, but rather to accept nominally the information provided by the applicant (including at a broader product level), relating to exports to third countries or to the reconstruction of normal value without critically examining or questioning such information in a way that guarantees its accuracy and relevance.

Third measure

The tax treatment granted to imported products within the framework of No. 7.212 / 2010 («IPI Regulation»), article 35, subsection II and §2 of Law No. 4,502 / 64, which provide for a general substitution regime («Tax Substitution Regime»), and article 17 of the Normative Instruction of the Brazilian Federal Recipe No. 1,081 of 2010, which expressly prohibits the application of the special substitution regime to the IPI in customs clearance – all these rules considered individually or as a whole – with respect to imported products, including PET film products.