OxyChem schedules the conversion of its Battleground chlor-alkali plant, located in Houston, USA, to membrane technology to begin in 2023 and be completed in 2026.

In 2022, this company’s capital expenditures amounted to $322 million.

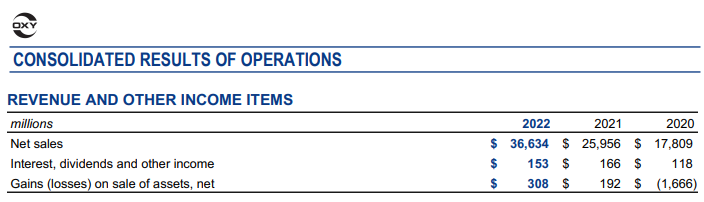

With net sales of US$36,634 million in 2022, OxyChem’s main activities are divided into three segments: oil and gas, chemicals and midstream and marketing.

As part of one of these segments, the company focuses on the chlorovinyl chain, starting with the co-production of caustic soda and chlorine. Caustic soda and chlorine are marketed to external customers.

In addition, chlorine, together with ethylene, is converted through a series of intermediates into PVC.

OxyChem seeks to be a low-cost producer in order to generate cash flow in excess of its normal investment requirements and to achieve a return in excess of its cost of capital.

OxyChem’s focus on chlorovinyls allows it to maximize the benefits of integration and take advantage of economies of scale.

Capital is used to maintain production capacity and focus on projects and developments aimed at improving the competitiveness of the segment’s assets.

OxyChem

Acquisitions and plant development opportunities may be pursued where they are expected to enhance existing core chlor-alkali and PVC businesses or take advantage of other specific opportunities.

Conversion of the Battleground chlor-alkali plant to membrane technology is expected to begin in 2023 and be completed in 2026. In 2022, OxyChem’s capital expenditures totaled $322 million.

Although U.S. economic growth lagged far behind that achieved in 2021, demand for domestically produced products remained high, including liquid caustic soda and PVC.

Blockades in China, along with Russia‘s invasion of Ukraine, increased demand for U.S.-produced products in 2022, as ethylene and energy costs remained above world prices.

While caustic soda prices rose significantly in 2022, PVC prices trended downward during the second half of 2022, as supply chain constraints, rising interest rates, global logistics and high inflation continued to disrupt global supply and demand balances.