The expected recovery of oil demand in China towards the end of the first quarter of 2023 could impact inflation in the world.

From Coface‘s perspective, China’s recovery could add fuel to the inflationary fire.

First and foremost, the easing of restrictions aimed at containing the transmission of the Covid-19 pandemic is an unexpected turn of events that should lead to a recovery in Chinese consumption.

As the sudden reopening was accompanied by an increase in infections, the rebound should be gradual.

According to epidemic projections, normalization of activity could begin by the end of the first quarter of 2023.

Therefore, according to Coface, a firmer recovery is expected in the second half of the year, creating the perfect conditions for a new storm on the energy front and, consequently, on inflation.

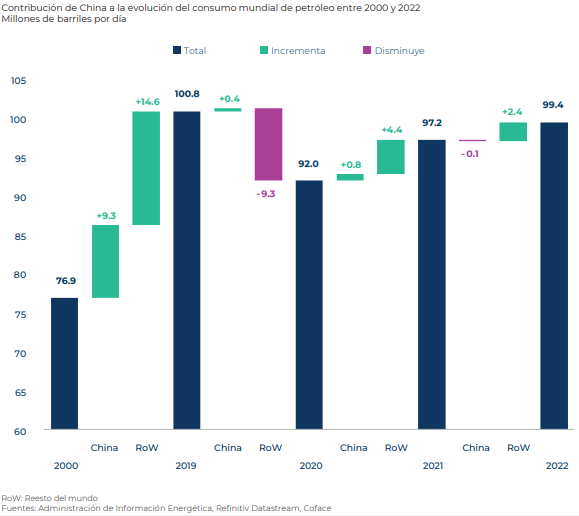

Responsible for around 40% of the increase in marginal oil demand between 2000 and 2019, a rapid normalization in the second quarter would exacerbate the supply-demand imbalance, pushing prices up again.

These renewed price pressures would also affect gas.

Last year, in a difficult economic environment, Chinese industry officials reported that total gas demand fell for the first time in 20 years, while LNG purchase volumes fell by around 20% after the peak in 2021.

This benefited European countries, allowing them to replenish their stocks and, with the help of mild temperatures, avoid supply disruptions in the winter of 2022-2023.

Oil demand

While pipeline flows from Russia to Europe are likely to remain close to zero, increased Chinese competition is likely to push gas prices back up on European and Asian markets, with a significant risk of a global supply deficit.

In fact, Coface believes that the new liquefaction capacities coming on stream in 2023 (Gulf of Mexico in particular) will not be able to fully meet the increase in global demand, especially if China were to recover more vigorously than currently expected, despite the efficiency gains observed, the increase in the share of nuclear power in the electricity mix of certain countries (Japan, South Korea, France for example), etc.

In addition, the recovery of industry and the construction sector in China will affect the prices of other raw materials, particularly base metals.

![]()