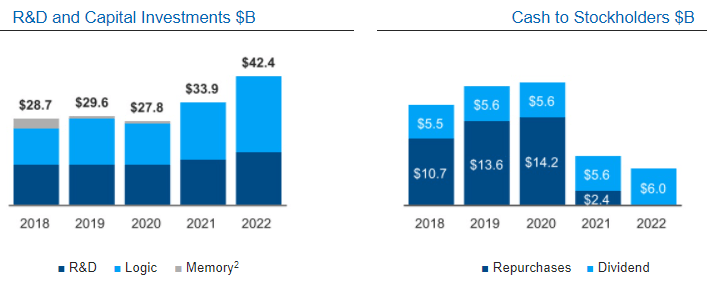

Intel, the world’s largest semiconductor chipmaker by revenue, recorded capital and research and development (R&D) investments of $42.4 billion in 2022, a year-over-year increase of 25.1 percent.

To accelerate its IDM 2.0 strategy, the company is investing in manufacturing capacity around the world.

Intel has broken ground on two new state-of-the-art chip fabs in Ohio, initially announcing plans to invest more than $20 billion to establish the first advanced semiconductor campus in the «Silicon Heartland.»

Investment of Intel

The company also announced plans to invest up to €80 billion in the European Union over the next decade across the entire semiconductor value chain, from R&D to manufacturing to advanced packaging technologies.

These include a plan to invest up to an initial €17 billion to build a state-of-the-art semiconductor manufacturing mega-plant in Germany; create a new R&D and design center in France; and invest in R&D, manufacturing and foundry services in Ireland, Italy, Poland and Spain.

Intel

To create greater financial flexibility while accelerating its strategy, the company announced SCIP, a program that introduces a new financing model in the capital-intensive semiconductor industry.

As part of this program, Intel closed a definitive agreement with Brookfield Asset Management (Brookfield), creating an equity partnership whereby Intel and Brookfield own 51% and 49%, respectively, of the newly formed entity, Arizona Fab LLC (Arizona Fab).

Intel expects Arizona Fab to invest up to $30 billion to expand the manufacturing infrastructure at our Ocotillo campus in Chandler, Arizona.

In addition, the company is seeking acquisitions to supplement and strengthen its capital. In the first quarter of 2022, it entered into a definitive agreement to acquire Tower Semiconductor Ltd. Tower in a cash-for-stock transaction.

Tower is a leading foundry for analog semiconductor solutions. The acquisition is expected to advance our IDM 2.0 strategy by accelerating Intel’s global end-to-end foundry business.

While continuing to work to close the acquisition in the first quarter of 2023, the transaction could close in the first half of 2023, subject to certain regulatory approvals and customary closing conditions.

![]()