Grupo Condumex, a subsidiary of Grupo Carso, was affected by the shortage of semiconductor chips in 2022.

The company was adversely affected last year by a lack of microcomponents and a lack of logistics capacity, which generated unplanned stoppages of 58 days for GM customers, 124 days for VW Puebla, 35 days for Audi and 31 days for VW Chattanooga.

In addition, the exchange rate represented a negative factor, as in 2021 the average was 20.2812 pesos per dollar versus 20.1255 in 2022.

These factors were offset by volume and price improvements due to the start-up of new programs such as VW’s ID4 and GM’s T1XX Global B, which led to a 9.2% increase in sales compared to the previous year.

Grupo Condumex participates in Grupo Carso’s industrial sector, which concentrates on the manufacturing and marketing of products and services for the construction and infrastructure, energy, automotive and telecommunications markets.

Of Grupo Condumex’s total sales last year, 27.9% corresponded to the automotive sector, while 53.3% to the construction and energy industries and 18.8% to telecommunications.

In 2022, GM Silao showed volume reduction compared to the previous year for the Pick UP it assembles in Silao; it manufactured 322,000 units in 2022 versus 340,000 units in 2021,

However, Ter 1 customer business represented by volume an increase of Ps. 79 million in 2022 compared to the previous year, mainly in customers Plastic Omnium, Mhale and ZKW.

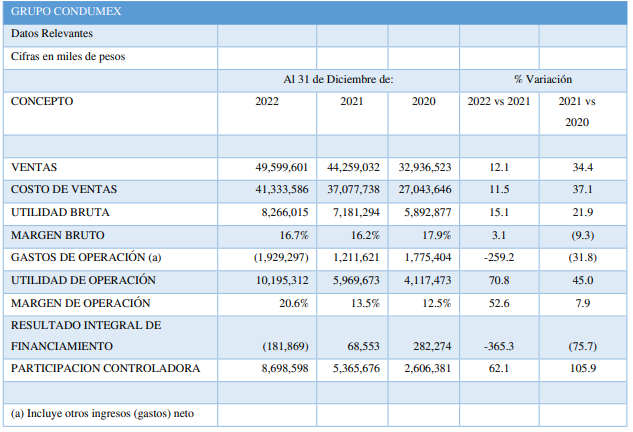

Grupo Condumex

Business with the VW consortium grew in 2022 by volume compared to the previous year, mainly due to the start-up of ID4, where in 2022, VW assembled 10,361 units, which compensated for the shutdown of Passat production in December 2021; the Atlas SUV (Terramount) produced 107,000 units in 2022 compared to 108,000 in 2021, with no representative differences.

But Audi Q5 had a growth of 19% producing 169,000 units in 2022 compared to 141,000 in 2021.

EBITDA in the auto parts sector rose 3.5% in 2022 versus the previous year, mainly due to lower raw material costs due to the incorporation of new businesses such as T1XX Global B and ID4, as well as harness purchase order updates in the second half of the year due to the management of cost recovery impacts from labor and raw material increases with customers.

Labor had an impact in 2022 with respect to 2021 due to a 22% increase in the official minimum wage in January 2022, which affected 77% of the workforce in its electrical harness assembly operations.