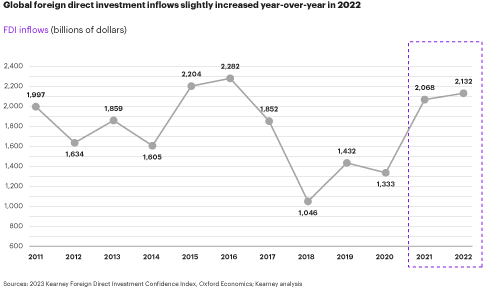

Global FDI flows recorded a 3.1% year-on-year growth in 2022, totaling $2.068 trillion, Kearney Consulting indicated.

Although FDI flows are not directly subject to the same types of physical disruptions as international trade (i.e., the ability to conduct financial transactions is not affected by issues such as port closures or physical distance), they respond similarly to changes in global economic conditions.

High uncertainty about global economic conditions and changes in the economic policy environment can reduce or reverse investment flows.

Also, according to the White House of United States, companies may decide to delay or suspend investment decisions when uncertainty is high and when investors find it difficult to determine when conditions are likely to normalize.

Following strong flows in the first quarter of 2022, high global inflation and tightening global financial conditions, as well as the compounding effects of the Russian invasion of Ukraine, caused individuals, businesses and governments to moderate global FDI flows in 2022.

Global FDI flows

After three years of turbulence associated with the disruptions of the Covid-19 pandemic, economic difficulties and geopolitical tensions in Eastern Europe, the Kearney survey was conducted at a comparatively stable time.

In January, the economic outlook for 2023 was far from robust – global output growth was forecast at less than 2% – but there was still reason for cautious optimism.

After months of economic projections pointing to a (potentially severe) recession, the International Monetary Fund‘s World Economic Outlook update released in January stated that global recession was no longer in its forecast.

And, according to Oxford Economics, global FDI inflows in 2022 increased slightly from an estimated $2.07 trillion in 2021 to $2.13 trillion.

To note: Kearney’s annual survey, the FDI Confidence Index, rates nations according to how confident investors are in their ability to attract foreign direct investment.

Since its initial publication in 1998, the index has grown to become one of the best-known indicators of FDI attractiveness. The index is based on a survey of multinational corporate executives, who were asked to rate nations on various aspects of their attractiveness for foreign direct investment.