According to data from the Ministry of Finance and Public Credit (SHCP), foreign trade revenues have declined in importance in Mexico over the last four years.

Of the total revenue collected by the federal government in 2024, foreign trade-related operations contributed 23.7%, after reaching 30.3% in 2020 and maintaining a downward trend.

Foreign trade revenues

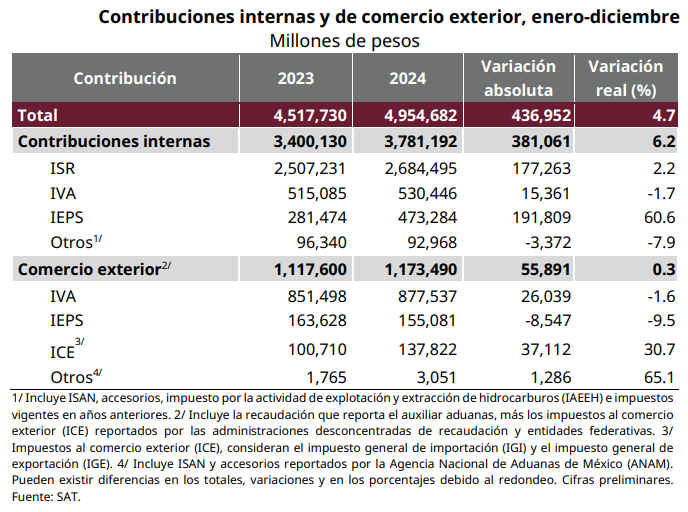

In 2024, domestic contributions in Mexico accounted for 76% of tax revenues. This is equivalent to 3 trillion 781,192 million pesos. Compared to 2023, the amount grew 6.2% in real terms.

Among these contributions, the IEPS stands out. Its collection increased by 191,809 million pesos, with a real growth of 60.6%.

Mexico’s foreign trade tax collection, in billions of pesos, and its contribution to total tax collection (percentage) is shown below:

- 2020: 969 (30.3 percent).

- 2021: 999 (28.0 percent).

- 2022: 1,080 (28.3 percent).

- 2023: 1,118 (24.7 percent).

- 2024: 1,173 (23.7 percent).

ICE

Foreign trade contributions totaled 1 trillion 173,490 million pesos between January and December 2024. Within this category, the collection of Foreign Trade Taxes (ICE), which reached 137,822 million pesos, stands out. This figure was 30.7% higher in real terms compared to the same period in 2023.

Federal tax collection includes federal taxes. These include Income Tax (ISR), Value Added Tax (VAT) and the Special Tax on Production and Services (IEPS).

On the other hand, non-tax federal revenues consist of various federal duties. These are mainly generated by the exploitation of hydrocarbons and minerals.

Since 2022, import and export customs clearance has been handled by Mexico’s National Customs Agency (ANAM).

This entity has key functions. On the one hand, it verifies the data in pedimentos, declarations and manifestations. In addition, it confirms the origin of the goods.

It is also in charge of collecting taxes and customs clearance fees. Finally, it supervises compliance with non-tariff regulations and restrictions.