Mexico will collect 64.179 billion pesos from foreign trade operations in 2022, which represents an increase of 13.4% compared to 2021, according to data from the Ministry of Finance and Public Credit (SHCP).

In order to contribute to the federal government’s goals, the annual foreign trade tax program is focused on increasing collection through automation and the development of data models to improve and make processes more efficient, which as of the fourth quarter of 2022 represents a real increase of 3,093.8 million pesos (5.1%), compared to the same period of the previous year.

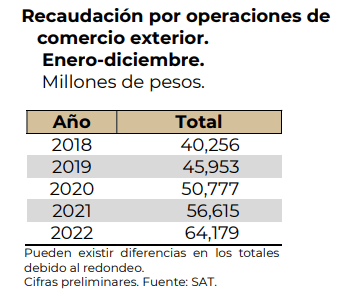

After totaling 40,256 million dollars in 2018, Mexican revenue from international trade operations was 45,953 million in 2019 and 50,777 million in 2020.

Mexico’s trade policy objectives are: to promote foreign trade, defend its trade interests, and negotiate, implement and administer trade agreements; the use of trade as an instrument to reduce poverty and socioeconomic inequalities has not yielded the expected results due to the excessive concentration of export activities in certain goods produced in a limited number of regions of the country.

To promote export diversification, one of the objectives of trade policy is to attract investment to sectors and regions that have historically had little participation in exports and to continue maximizing the benefits granted under existing incentive programs, specifically export promotion regimes, according to information from the World Trade Organization (WTO).

Foreign trade

As part of its trade strategy, Mexico also promotes the empowerment of women.

The scope of the trade policy will also depend on the development of an adequate transportation and logistics infrastructure.

Mexico’s Constitution stipulates the powers of the federal government and the states. The latter exercise all those powers that have not been «expressly granted» to the federal state.

For example, the federal state has the «privative power» to tax imports, exports and transit of goods, as well as to regulate (even prohibit) the circulation of goods within the national territory.

The Constitution prohibits the federal entities from carrying out certain activities; for example, they may not sign international treaties, mint currency, incur obligations abroad or in foreign currency, or tax the transit, entry or exit of goods from their territory.

However, if authorized by the Mexican Congress, states may impose taxes or duties related to foreign trade.

![]()