What are the main financial indicators for multiple banking in Mexico from 2017 to 2021? Part of the WTO‘s answer is given as follows.

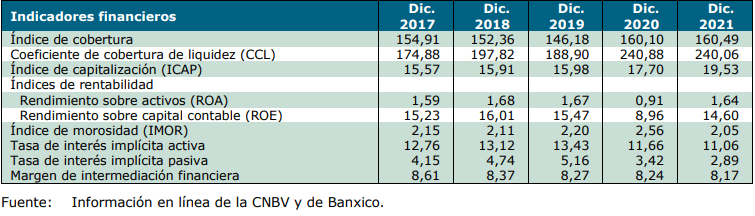

Commercial banking in Mexico continued to present an adequate delinquency rate and a good level of solvency and liquidity during the last five years, with positive profitability indexes.

Although in 2020, as a result of the contraction in economic activity, there was an increase in the NPL ratio (up to 2.56 percent), it remained low and declined in 2021 to its pre-pandemic levels (2.21 percent).

The pandemic also affected profitability, especially in 2020; from 2021 onwards, an increase in profitability is evident.

At the same time, the coverage ratio remained high.

Financial indicators for commercial banks, 2017-2021 (percent)

Financial indicators of commercial banks

Mexico has been applying Basel III rules since 2015, particularly in terms of solvency and liquidity.

The capitalization index (ICAP), which measures solvency, has at all times remained well above the required minimum of 10.5%, even during the Covid-19 pandemic.

In December 2021, this ratio was 19.5%, almost double the required level, which is evidence of the high degree of capitalization of Mexican banks.

Also, the high ratio is partly a reflection of the delinquency of the economic situation during the pandemic, and the increase in savers’ deposits.

In 2015, Mexico introduced the liquidity coverage ratio (CCL) to strengthen the resilience of its banking system. This measure ensures that banks can meet their financial obligations over a 30-day horizon.

To comply, each institution must maintain a CCL above 100%. In other words, the value of its liquid assets must match or exceed projected cash outflows.

The rollout of the CCL was gradual. It varied based on the size of the bank and its years of operation.

Since 2016, all banks are required to meet a minimum CCL threshold. This requirement adjusts according to each bank’s size. In addition, multiple institutions must also fulfill capital conservation and countercyclical buffer requirements.

The main multiple banking companies in Mexico include BBVA Mexico, Santander, Banamex, Banorte, HSBC, Scotiabank and Inbursa, according to the National Banking and Securities Commission (CNBV).