China has established itself as the world’s largest robot market, exerting a growing influence on technology trends and global industry standards.

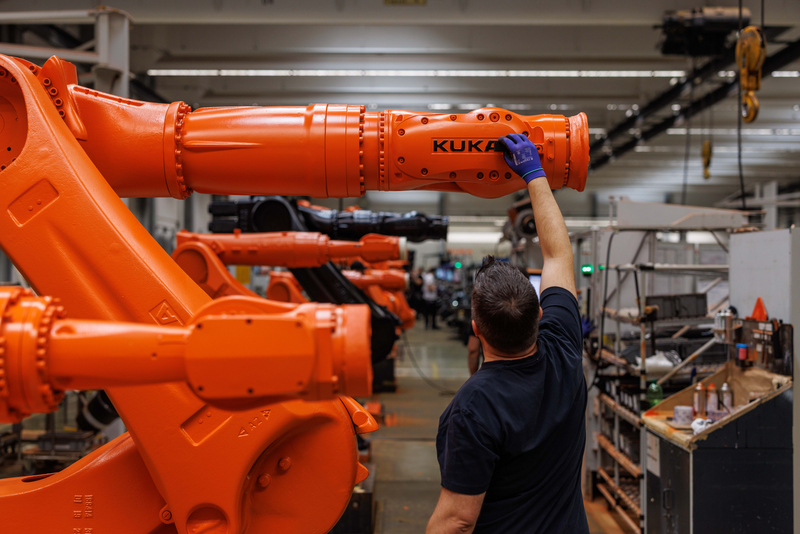

For decades, robots have been part of production lines around the world. Their commercial use began with a concrete promise: to automate repetitive tasks with greater speed, precision and strength than a human being.

In most cases, they are large, stationary robotic arms. These machines operate in controlled environments, such as assembly lines, where every second counts and the margin for error must be minimal.

World’s largest robot market

According to KUKA, Chinese companies are not only expanding their domestic market share, but are also entering premium segments by offering standard technology at competitive prices.

As a result, KUKA has continuously expanded its presence in Europe, North America and China. In recent years, the company has invested heavily in the Chinese market to better address the specific needs of local customers and shorten the time to market.

Industrial robots generally execute plans through mechanical programming (functions previously programmed by a human engineer). Over time, industrial robots have become more sophisticated and are now widely adopted in a wide variety of applications and across many industries.

Below are the world’s largest exporters of industrial robots in 2024, in millions of dollars and their year-on-year growth rate, according to World Trade Organization (WTO) data:

- Japan: 1,280 (-41 percent).

- Germany: 639 (-19 percent).

- China: 573 (+27 percent).

- Italy: 390 (+6 percent).

- Denmark: 390 (+1 percent).

Globally, industrial robot exports totaled $6.042 billion, a 17.5 percent drop over 2023.

Outlook

Despite global adjustments in manufacturing, the long-term projection remains positive. This is the view of the International Federation of Robotics (IFR), which anticipates a steady expansion in the industrial robot market.

According to its estimates, the number of robots installed worldwide will grow at a compound rate of 4% per year between 2024 and 2027. The pace is steady. In 2024, it is expected to close with around 541,000 units. By 2025, the forecast rises to 555,000. In 2026, the figure would rise to 575,000 and, by 2027, more than 601,000 industrial robots are projected to be operating globally.