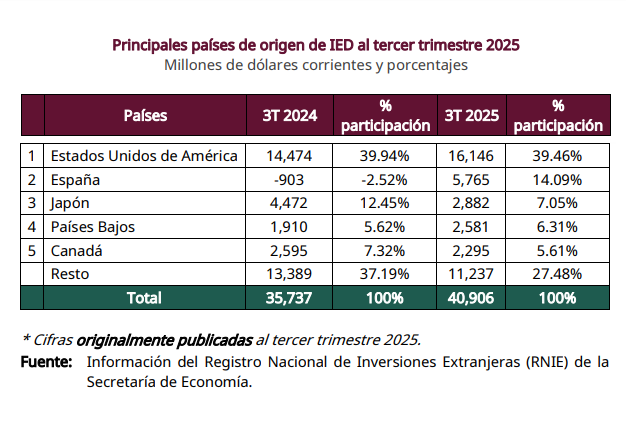

The main sources of FDI in Mexico during the first three quarters of 2025 were the United States, Spain, Japan, the Netherlands, and Canada.

The United States contributed $16.146 billion, followed by Spain ($5.765 billion) and Japan ($2.882 billion).

Next were the Netherlands ($2.581 billion) and Canada ($2.295 billion).

Sources of FDI in Mexico

These five sources accounted for 27.48% of total foreign direct investment inflows to Mexico. The percentage grew slightly compared to their combined contribution of 37.19% in the same period of 2024, according to data from the Ministry of Economy.

Mexico received $40.906 billion in FDI from January to September 2025, which is 14.5% more than in the same period of 2024.

Comparisons are made between figures originally published for the third quarter of 2024 and figures originally published for the third quarter of 2025.

Outlook

For the Ministry of Finance and Public Credit (SHCP), FDI will continue to favor industrial development, job creation, and the adoption of new technologies in strategic sectors.

Likewise, investments in the south of the country—such as Line K of the Interoceanic Railway—will promote regional productive integration, generating productive linkages in the states and reducing historical inequalities.

According to federal government forecasts, the current account balance will register a moderate average deficit of 0.4% of GDP between 2027 and 2031.

This result will be determined mainly by growth in the United States, which will allow for an increase in Mexican exports and a positive flow of remittances from workers of Mexican origin. The growing inflow of FDI will remain an important source of financing for the current account in the medium term. As a result, the exchange rate will remain stable at around 18.3 pesos per dollar.