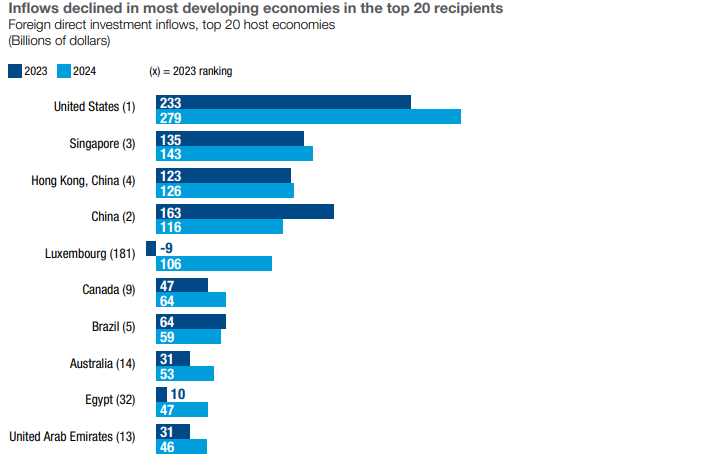

The United States, Singapore and Hong Kong occupied the top positions among the most FDI-attracting economies in the world, according to the ranking prepared by UNCTAD for 2024.

As a starting point, foreign direct investment occurs when a person or company from one country invests in a company from another country and has control or influence over it.

With that characteristic, FDI inflows are the money that the investor puts into or receives from the foreign company. Outflows show that same money as seen from the other country.

Thus, FDI flows are calculated as the difference between inflows and outflows. Therefore, if there is disinvestment, the result may be negative.

Most FDI-attracting economies

Global FDI flows fell 11% year-on-year, reaching 1.53 trillion dollars. The figure is expressed in comparable terms.

To make a more realistic calculation, UNCTAD eliminated volatile financial transactions. These transactions went through European economies with high levels of channel flows.

Without this adjustment, overall flows would have shown a year-on-year increase of 4 percent.

The following are the top FDI attracting economies in the world, with 2024 data, in millions of dollars:

- United States: 279,000.

- Singapore: 143,000.

- Hong Kong: 126,000.

- China: 116,000.

- Luxembourg: 106,000.

- Canada: 64,000.

- Brazil: 59.

- Australia: 53.

- Egypt: 47.

- United Arab Emirates: 46.

- Mexico: 37.

- France: 34.

- Spain: 31.

- Indonesia: 24.

- India: 28.

- Vietnam: 20.

- Italy: 25.

- Sweden: 18.

- Israel:17.

- Saudi Arabia: 16.

Outlook

Although at the beginning of the year a moderate growth in world FDI was anticipated, the scenario has changed. Economic and political uncertainty has gained ground.

In addition, the new escalation in trade tensions has deteriorated investor confidence. This has directly affected the pillars of FDI: global GDP growth, international trade and exchange rate stability.

On top of this, financial volatility has also increased. Markets are reacting cautiously.

First-quarter data confirm the trend. Investment transactions and new project announcements fell to historic lows. A clear sign of global cooling.

According to UNCTAD, the economic slowdown is becoming increasingly evident. Projections for GDP growth, trade and capital formation have been adjusted downwards.

Added to this are persistent risk factors: high debt levels, political instability and weak business confidence indicators.