Related companies account for 69% of US imports from Mexico, according to data from the Census Bureau.

The USMCA is the foundation of North America’s economic success, and the Business Roundtable (BRT) urged President Donald Trump’s administration to maintain and strengthen the trilateral relationship.

Related companies

According to the BRT, maintaining the USMCA as a trilateral agreement is vital for the United States. It guarantees its strategic and economic advantage in North America. Key sectors such as automotive, energy, and agriculture depend on integrated supply chains throughout the region.

More than 30 years of regional free trade have enabled U.S. companies to develop production networks across the continent.

Harmonized standards, binding commitments, and the elimination of tariffs and other barriers have reduced costs, expanded access to competitively priced inputs, and allowed companies to organize production in the three countries according to their comparative advantage.

In addition to the large volume and growth of trade and investment flows among USMCA partners, a substantial amount of cross-border trade within the USMCA involves intermediate inputs that move within well-integrated supply networks.

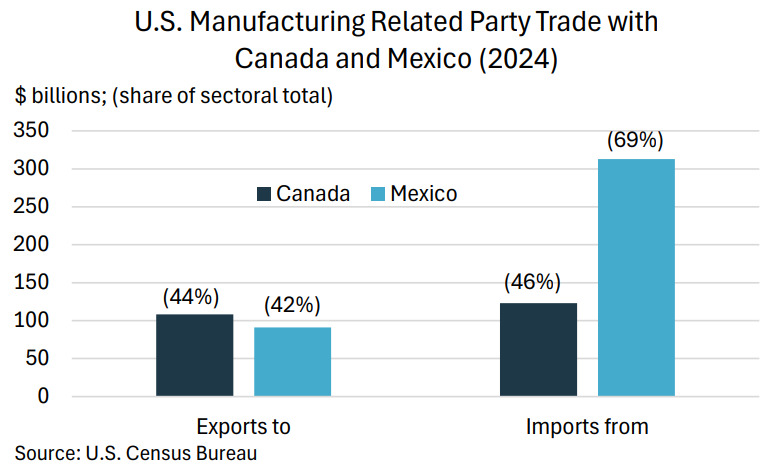

Data from the U.S. Census Bureau on related-party trade show the close ties between U.S., Canadian, and Mexican manufacturing through shared production networks.

Regionalization

In 2024, more than half of U.S. manufacturing trade with Canada and Mexico was between related parties (i.e., between companies and their own cross-border affiliates).

Specifically, 44% of U.S. manufacturing exports to Canada and 42% to Mexico were intra-firm, while 46% of imports from Canada and 69% of imports from Mexico came from related companies.

These flows reflect regional co-production—companies designing, sourcing, and assembling goods under the USMCA—rather than a simple transactional relationship with a foreign supplier.

This regionalization keeps production close to home, under the shared labor and environmental standards of the USMCA, and strengthens supply chain resilience by reducing dependence on other regions.

Similarly, data from the Organization for Economic Cooperation and Development (OECD) helps highlight how North American trade maintains U.S. value within the region.

According to OECD value-added trade indicators, approximately 15% of the value of U.S. imports of manufactured goods from Canada and Mexico reflects U.S. labor—materials, parts, design, or services—returning to the country.

In contrast, imports from China contain less than 2% U.S. value.

“In short, every dollar of manufactured imports from North America drives more domestic economic activity and job creation in the United States than trade with more distant partners,” the BRT said.