The American Petroleum Institute (API) has stated that Mexican state-owned companies are violating the rules of the United States-Mexico-Canada Agreement (USMCA).

Chapter 22 of the USMCA stipulates that state-owned enterprises and their competitors must have equal opportunities to compete in each nation’s markets, ensuring that state-owned enterprises do not enjoy benefits or conditions that are not available to their private competitors.

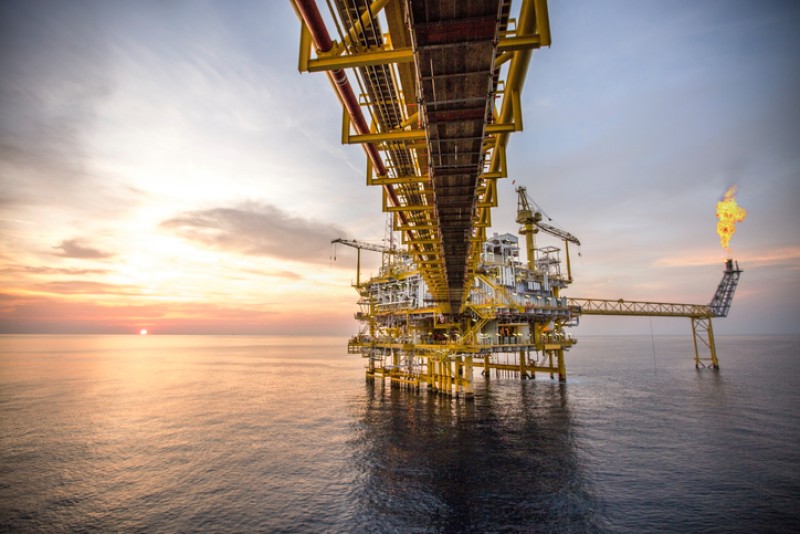

Mexican state-owned companies

In a letter to the White House Trade Representative (USTR), the API stated that Mexico has not fulfilled its commitments under the USMCA in this regard.

From its perspective, the USTR should negotiate that Mexico: reinstate its Asymmetric Pricing Regulation; exclude Pemex employees from their de facto law enforcement functions; repeal CUFIN; and expedite and grant pending permits for U.S. private sector energy infrastructure.

The API argued that Pemex enjoys solid advantages in fuel pricing, advantages that are not available to its competitors and that have increased since Mexico’s former Energy Regulatory Commission (CRE) repealed the Asymmetric Pricing Regulation in December 2019, a rule designed to limit Pemex’s dominance in the market by regulating the company’s retail fuel prices, which introduced greater competition in the market.

The rule was reinstated by the Supreme Court of Justice of the Nation in 2021, but recently overturned again by the National Energy Commission (CNE).

For the API, this annulment allows Pemex to exercise its market dominance and pricing power to harm its competitors and maintain a significant advantage in refining and distribution prices.

Asymmetric pricing

The API indicated that the USTR should also pressure the Mexican government to exclude Pemex from the tanker truck inspection process to detect illegal fuel shipments.

The Ministry of Energy (Sener) and the National Energy Center (CNE) oversee inspections of tanker trucks and privately-branded gas stations in Mexico to detect illegal fuel shipments, which is a normal government function.

However, Pemex often provides assistance in these tasks, which, in the API’s opinion, gives it an inherent economic advantage as a market participant.

For example, Pemex could provide cargo manifests, pipeline flow records, and other distribution data to inspection agencies.

The government could also place inspectors on Pemex trucks, cross-checking bills of lading with dispatch records and verifying that shipments match official records.

However, as a market participant, Pemex controls most of Mexico’s fuel imports, refining, storage, and pipeline infrastructure.

Therefore, the API argued that by acting as de facto law enforcement agents and, as a result, gaining unprecedented visibility into market logistics and prices, Pemex has a competitive advantage over U.S. energy companies seeking to operate in that country.