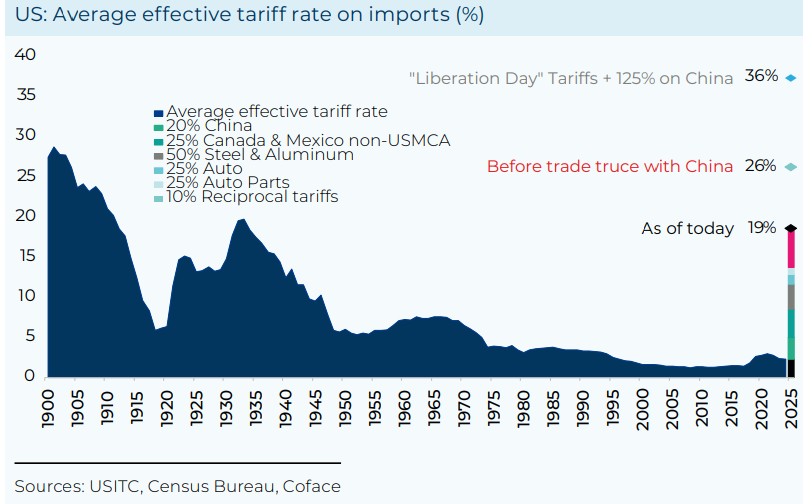

How much did US tariffs increase? French credit insurer Coface gives the answer, present and potential.

Until June 2025, the average effective U.S. tariff rate on imports was 19 percent.

How much did tariffs increase

Before the trade truce with China, the average U.S. effective tariff rate was 26 percent.

Finally, if the tariffs announced on “Liberation Day” and the 125 percent tariff on China were added, the average U.S. effective tariff rate would be 36 percent.

According to Coface, the latter tariff would be the highest U.S. tariff ever.

Coface believes that the global economic outlook is uncertain and depends on geopolitical and trade decisions by the United States. If Trump reinstates the suspended tariffs, global growth could be hit harder than expected. Although tariffs are at record levels in recent decades, their effect on the trade deficit will In the short term, Coface projects that a recession in the United States seems unlikely. But it anticipates a global slowdown. China is also facing weakened demand. If the trade war or regional conflicts escalate, Coface estimates that global growth could fall below 2%. In addition, inflation remains uncertain and could pick up if there are trade retaliations.

US economy

The Federal Reserve projects that US real GDP growth will be 1.4% in 2025 and 1.6% in 2026, according to the latest FOMC median projections presented after the June 2025 meeting

In turn, Coface forecasts that inflation could moderate in several emerging economies thanks to falling commodity prices and a weaker dollar. However, rising energy prices remain a risk, especially due to tensions in the Middle East.

In the face of this uncertainty, the main central banks are likely to act cautiously. Coface forecasts that disinflation will return in the second half of 2026 in the United States, which would allow the Fed to resume rate cuts. In Europe, uncertainty is greater, especially because of possible fiscal adjustments.