Greenfield projects in the extractive industries slowed down in 2024, UNCTAD reported Thursday in its annual investment report.

In case there is any doubt, here is the answer to the question of what greenfield projects are: they are a form of Foreign Direct Investment (FDI) in which a company develops operations in another country from scratch.

Instead of acquiring existing assets, the company builds new facilities. This may include production plants, offices or logistics centers.

Thus, a greenfield project boosts job creation, technology transfer and local development. It is therefore key to international expansion strategies.

Greenfield projects

In 2024, according to its World Investment Report 2025, UNCTAD reports that the total number of greenfield projects increased at a year-on-year rate of 3%, reaching 19,356.

The following are the best positioned countries in this indicator:

- United States: 2,460.

- United Arab Emirates: 1,359.

- United Kingdom: 1,193.

- India: 1,080.

- Germany: 887.

In contrast, the value of greenfield projects fell at a year-on-year rate of 5.3%, to US$1,338 billion.

Extractive industries

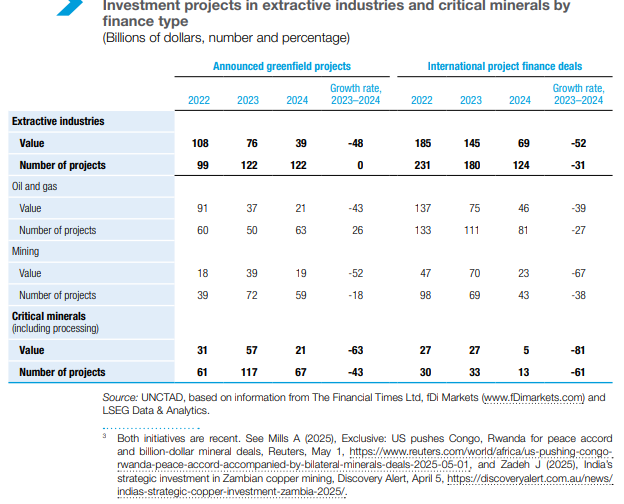

After two years of robust activity, greenfield project activity in the extractive industries slowed in 2024. UNCTAD reported that the total value of newly announced projects nearly halved to approximately US$40 billion, returning to its long-term average.

Falling energy prices and volatility in critical minerals generated caution among investors. Still, demand for lithium, cobalt and rare earths maintained some investment.

Countries in Africa and Latin America, such as DRC, Zambia, Argentina and Chile, continued to attract projects, despite the high risks.

China maintains a strong position in mining in less developed countries, while the United States and India are also moving forward with state support.

Investments in intellectual property declined, and several projects were delayed due to environmental requirements and risk reassessment.

Despite the context, demand linked to the energy transition sustains strategic interest.