Brazil has increased its imports of high-tech products from China in recent years, according to a report by the Central Bank of Brazil (BCB).

In general, Brazil has increased its agri-food sales to the Chinese market, while China increasingly ships manufactured products to the Brazilian market.

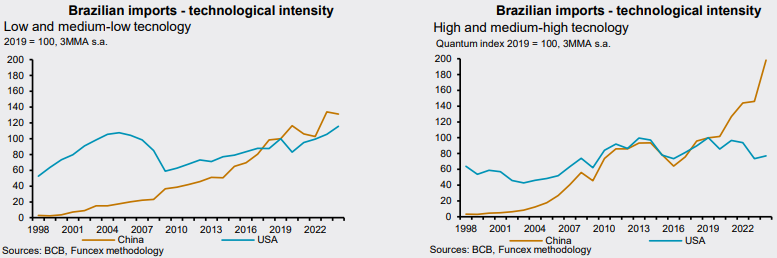

In 2024, the volume imported by Brazil from China was 98% higher than that observed in 2019, the year before the Covid-19 pandemic. This movement is particularly noticeable from 2021 onwards, with a sharp acceleration in 2024.

In early 2025, the movement intensified with oil rig imports worth 2.7 billion.

Imports of high-tech products

On the contrary, the BCB refers that the participation of the United States as the origin of Brazilian imports has followed a downward trend since 2001, although oscillating throughout the period, with a 23% decrease in the amount imported in relation to 2019.

Moreover, the greater representativeness of the Asian country occurred not only in terms of volume, but also in the degree of technology associated with the goods. As of 2019, China surpassed the United States in sales of goods classified as high and medium/high technology.

Agreements with China

On May 13, 2025, Brazil and China signed 20 agreements during President Luiz Inácio Lula da Silva’s four-day visit to Beijing. Three of them opened five new agricultural markets for Brazil. China authorized the import of duck meat, turkey meat, chicken viscera, corn ethanol derivatives and peanut meat.

These agreements also included key advances in sanitary and phytosanitary cooperation. The rest of the agreements boosted technological collaboration and reaffirmed both countries’ commitment to a more cooperative and multipolar world.

The Chinese economy maintained its momentum at the beginning of 2025. GDP grew 5.4% year-on-year in the first quarter. This was the same rate as at the close of 2024 and higher than that recorded in the previous two quarters. Thus, the country is making progress towards the 5 percent growth target.

The dynamism was reflected in all sectors. The secondary sector contributed 3.2 percentage points. In turn, the tertiary sector contributed 2.1 points. Even the real estate sector showed signs of recovery, with a 1.0% increase for the second consecutive quarter.

On the demand side, household consumption led growth. Its contribution rose to 2.8 points. In contrast, investment and external demand subtracted 0.8 and 0.4 points, respectively.