Aptiv’s net income plummeted at a year-on-year rate of 90.8% in 2025, to $165 million.

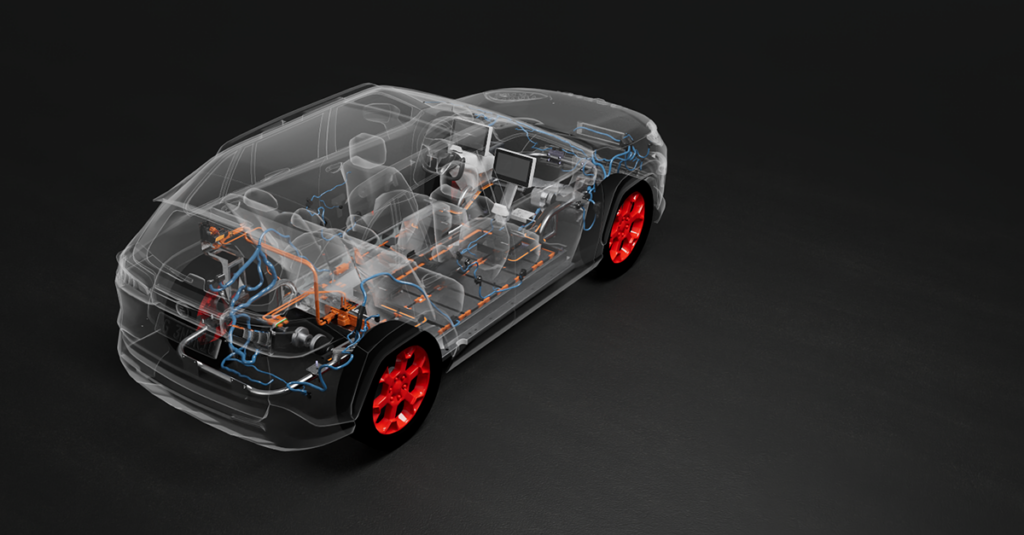

Aptiv is a leading global provider of vehicle technology specializing in software solutions, smart sensors, and electrical distribution systems for the automotive and telecommunications industries.

Aptiv’s net income

In 2025, revenue totaled $20.398 billion, an annual growth of 3%. The advance was driven by North America and Asia-Pacific. In addition, expansion in industrial markets stood out, offsetting volatility in global automotive production.

However, net income declined. The decline was primarily due to a non-cash goodwill impairment charge of $648 million related to the Wind River unit. This adjustment was in response to higher discount rates and delays in the mass adoption of software-defined vehicles.

The trend in Aptiv’s net income in millions of dollars is shown below:

- 2019: $990.

- 2020: $1,804.

- 2021: $590.

- 2022: $594.

- 2023: $2,938.

- 2024: $1,787.

- 2025: 165.

As part of its strategy to capitalize on the potential of connected intelligent systems, Aptiv acquired Wind River Systems, Inc. in December 2022. The transaction sought to strengthen its capabilities in software-defined mobility and accelerate advanced changes in intelligent vehicle architecture.

Wind River is a global leader in intelligent edge software across multiple industries, including automotive. Its portfolio integrates mixed-criticality solutions that enable cloud development, OTA updates, and the execution and management of software directly at the vehicle edge.

Electric distribution

Taxes increased significantly due to charges associated with the separation of the Electrical Distribution Systems business. In addition, costs of $178 million related to the spin-off had an impact, along with higher expenses for corporate compensation and employee incentives.

On January 22, 2025, the company announced its intention to spin off that business to create a new, publicly traded independent company. The transaction will be a tax-free spin-off for shareholders. The closing is expected before April 1, 2026, subject to customary conditions.

In the competitive environment, it faces Adient, BorgWarner, Lear, and Tesla. Competition is intense in automotive technology. In addition, it competes with manufacturers that develop internal solutions, which requires constant innovation to maintain market acceptance.