The demand for onshore oil platforms in the United States registered a decrease of 54.3% in 2020 on the basis of 2019, the company Helmerich & Payne reported.

Thus, there was a corresponding dramatic decrease in demand for onshore oil rigs, such that the total rig count for calendar year 2020 averaged about 430 rigs, significantly lower than in calendar year 2019, which averaged about 940 rigs.

In early March 2020, increased crude oil supply resulting from escalating production by the Organization of the Petroleum Exporting Countries and other oil-producing nations (OPEC +) was combined with a decline in oil demand. crude oil, stemming from the global response and uncertainties surrounding the Covid-19 pandemic, and resulted in a sharp drop in crude oil prices.

Specifically, during calendar year 2020, crude oil prices fell from about $ 60 per barrel to the low-to-medium range of $ 20 per barrel, lower in some cases, resulting in customers reducing their capital budgets to 2020 by almost 50% from calendar year 2019 levels, according to Helmerich & Payne.

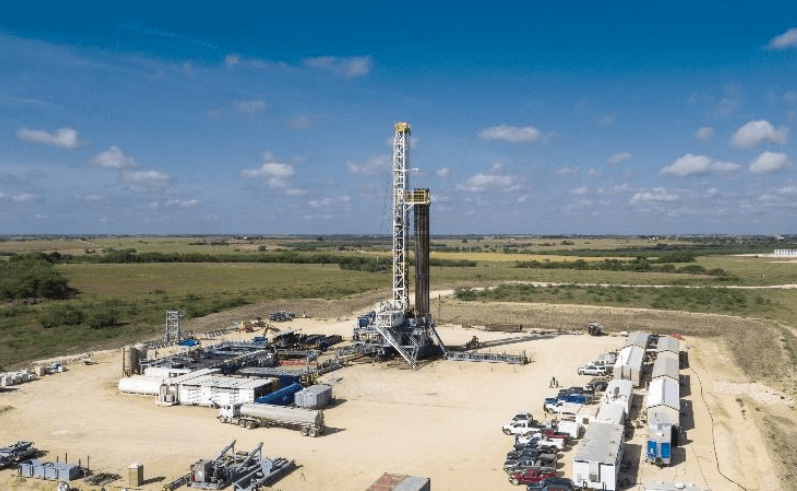

Oil platforms

The technical requirements of drilling longer lateral wells often require the use of superspecified rigs and even when they are not required for shorter lateral wells, there is a strong customer preference for superspecifications due to the drilling efficiencies obtained by using a superspecified platform.

As a result, there has been a structural decline in the use of non-superspecified rigs throughout the industry.

However, as a result of having a large super-spec fleet, Helmerich & Payne gained market share and became the largest supplier of super-spec equipment in the industry.

As such, the company believes that it is well positioned to respond to various market conditions.

The pace of unconventional drilling over the years has been cyclical and volatile, dictated by fluctuations in crude oil and natural gas prices, which have at times proven to be dramatic.

Oil and gas prices can be volatile at times depending upon both near and long-term supply and demand factors.

![]()