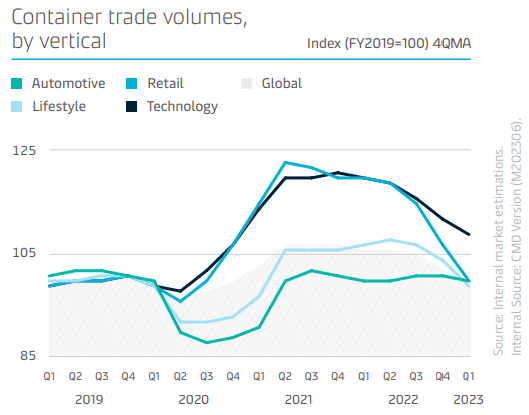

In the second quarter, container demand declined between 4 and 6.5% year-on-year, due to weak import growth in North America, Oceania and Far East Asia.

The shipping industry is critical to international trade, as it is the only viable and economical way to transport large volumes of many essential commodities and finished goods around the world.

According to Maersk, the combination of recession concerns and high inventories has resulted in little growth in demand for container trade and logistics services.

Imports in Europe showed signs of improvement in the second quarter after a very weak run and, together with positive import growth in West Central Asia and sustained import improvement in Africa, offset some of the weakness elsewhere.

On the supply side of the ocean market, the increasing flow of vessel deliveries and still limited scrapping activity are driving fleet growth.

Globally, the nominal container fleet stood at 27.3 million TEUs at the end of Q2 2023, an increase of 6% compared to Q2 2022.

In addition, the easing of bottlenecks in the supply chain and lower demand on long-haul routes are freeing up capacity in the market.

Container demand

SeaIntel data shows that the share of the global container fleet absorbed by delays declined from a January 2022 peak of nearly 14% to a post-pandemic low of 3.6% in May 2023.

Some of the available capacity is being absorbed by slowing shipping and cancelled sailings.

According to Clarksons, the average containership speed decreased 3% from 14.4 knots in Q2 2022 to 13.9 knots in Q2 2023.

However, the gap between demand and supply growth continued to widen in Q2 on a year-on-year basis.

Scrapping activity was moderate in the first half of the year, but is expected to increase going forward.