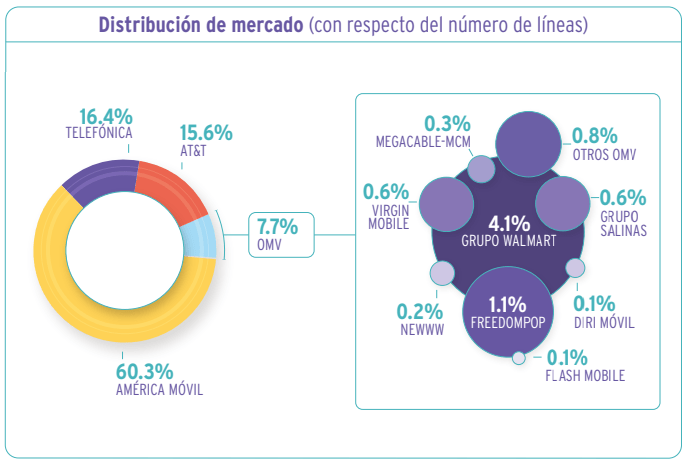

Competition between América Móvil, owner of the Telcel brand, and Telefónica, owner of the Movistar brand, continues in Mexico, but both have lost market share in terms of the number of lines.

According to the latest statistics from the Federal Telecommunications Institute (IFT) corresponding to the last quarter of 2022, América Móvil had a 60.3% share of the mobile telephony service market in Mexico, down from 63.4% in the fourth quarter of 2021.

In 2000, Teléfonos de México (Telmex), a Mexican fixed-line telecommunications operator privatized in 1990, spun off its wireless operations in Mexico and other countries. América Móvil was born.

After making major acquisitions throughout Latin America, the United States, the Caribbean and Europe, and expanding its business organically, América Móvil is one of the world’s largest telecommunications companies in terms of subscribers.

At the end of 2022, it reported 135 million 926,000 mobile telephone service lines in Mexico.

On the other hand, Telefónica decreased its share from 18.2% to 16.4% in the fourth quarters of 2021 and 2022, respectively.

Incorporated in Spain in 1924, Telefónica is a multinational telecommunications company with a significant global presence.

América Móvil

AT&T also lost market share in the mobile telephony service market in Mexico, going from 15.9% in the fourth quarter of 2021 to 15.6% in the fourth quarter of 2022.

In contrast, Mobile Virtual Network Operators (MVNOs) increased their market coverage from 2.5% to 7.7% in the same comparison.

Competition

América Móvil faces competition from various multinational and national providers. Major multinational competitors include AT&T, Telefónica, and Millicom, while national players such as Telecom Argentina in Argentina and Telecom Italia in Brazil also compete in their respective markets.

The competitive landscape remains fierce due to several factors. Market saturation, both fixed and wireless, drives competition. Additionally, increased network investments by rivals, the development and rollout of new technologies, the introduction of innovative products and services, and new market entrants contribute to the intense competition. Changes in spectrum availability and regulatory adjustments further impact the competitive environment.