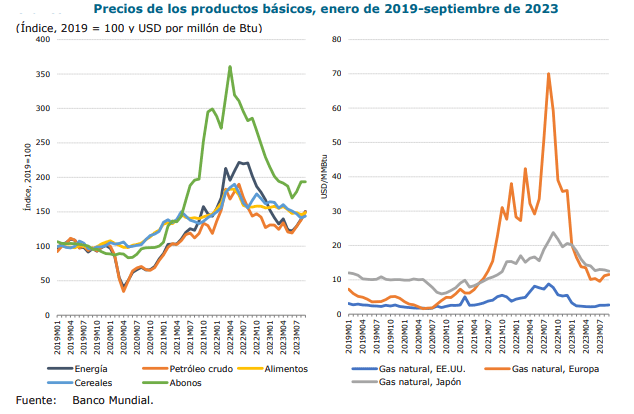

Commodity prices have declined from the peak levels reached in 2022, but remain high compared to previous periods.

By September 2023, the average crude oil price had risen 50% over 2019, while European natural gas prices had risen 140%, according to a WTO report.

Moving forward, the WTO warns that sharp winter energy price hikes in the northern hemisphere could again undermine trade and production growth as they did in 2022.

For the time being, falling commodity prices helped to reduce headline inflation in many economies, but core inflation (which does not include volatile food and energy prices) has held up.

In September, headline inflation stood at 3.7% in the United States and 4.3% in the euro area. Well above central bank targets.

For its part, China was almost in a state of deflation.

Commodity

Since March 2020, and throughout the past two years, global markets and commodity prices have been extremely volatile due to the impacts of the Covid-19 pandemic, with greater volatility impacts caused by the war in Ukraine that began in February 2022.

CoJax Oil and Gas Corporation indicated that commodity prices remained stable during the fourth quarter of 2022 as demand continued to outpace relative supply.

While recessionary concerns have put some downward pressure on commodity prices, causing oil and gas prices to decline in the first quarter of 2023 from their previous highs in 2022, global commodity demand continues to outpace pre-pandemic levels.

Although supply has increased and a continued recovery in commodity prices has been seen since the start of the pandemic, there is still an element of volatility and uncertainty that CoJax Oil and Gas Corporation expects to continue at least in the near term and possibly longer term, in part because of the impact of the Russian-Ukrainian military conflict on global commodity and financial markets, and the associated effect of trade sanctions on Russian oil and natural gas imports.

This volatility could negatively impact future prices for oil, natural gas, petroleum products and industrial products.